Unlicensed Real Estate: Verify Credentials, Protect Yourself

The dangers of unlicensed real estate activity are escalating, prompting urgent calls for consumers to verify credentials and understand protective measures. This report provides critical updates on how to safeguard transactions and identify illicit operations across the United States.

Unlicensed real estate dangers are a growing concern for individuals navigating property transactions in the United States. Recent reports highlight an uptick in fraudulent activities, emphasizing the critical need for buyers and sellers to verify credentials and protect themselves against significant financial and legal risks. This guide will clarify what constitutes unlicensed activity, how to spot it, and the essential steps to ensure your real estate dealings are legitimate and secure.

Understanding Unlicensed Real Estate Activity

Unlicensed real estate activity occurs when an individual or entity performs actions requiring a real estate license without holding a valid one. This can involve a wide range of services, from listing properties for sale or rent to negotiating deals and handling client funds. Such activities are illegal and expose consumers to substantial risks, as these individuals operate outside regulatory oversight and professional standards.

The real estate industry is heavily regulated to protect the public from fraud and incompetence. State licensing boards establish strict requirements for agents and brokers, including education, examinations, and ongoing professional development. When someone operates without this license, they bypass these crucial safeguards, potentially leading to devastating consequences for unsuspecting clients.

What Constitutes Unlicensed Activity?

- Listing and Selling Property: Advertising or showing properties for sale or lease without a valid license.

- Negotiating Deals: Representing buyers or sellers in negotiations or drafting contracts without proper authorization.

- Handling Client Funds: Managing earnest money deposits, rental payments, or other client funds without being a licensed escrow agent or broker.

- Providing Advice: Offering professional real estate advice, market valuations, or legal interpretations without the required credentials.

Engaging with an unlicensed individual for any of these services means foregoing essential protections, including access to state recovery funds in cases of fraud or misconduct. It also means dealing with someone who may not have the necessary knowledge of real estate laws, ethics, and market practices, leading to costly errors or deliberate deception.

The Grave Risks of Engaging Unlicensed Individuals

The decision to engage with an unlicensed real estate agent or broker, whether knowingly or unknowingly, carries profound financial, legal, and emotional consequences. These risks are not merely theoretical; they translate into tangible losses for consumers who find themselves entangled in illicit transactions. The absence of regulatory oversight means there is little recourse when things go wrong, leaving victims in precarious situations.

Financial losses are perhaps the most immediate and devastating outcome. Unlicensed agents often misappropriate funds, vanish with deposits, or facilitate transactions that are legally unsound, resulting in lost investments or substantial repair costs. Beyond money, the legal ramifications can be complex, involving disputes over property titles, unenforceable contracts, and even personal liability for actions taken under false pretenses.

Financial Pitfalls and Legal Liabilities

When you work with an unlicensed individual, you lose the protection of state regulatory bodies and professional insurance. Licensed agents are typically bonded and insured, providing a safety net against errors and omissions. Without this, any financial damages incurred fall directly on the consumer. This includes risks like:

- Loss of Earnest Money: Unlicensed individuals may abscond with deposits, leaving buyers with no way to recover their funds.

- Unenforceable Contracts: Agreements brokered by unlicensed agents may be deemed invalid by courts, leading to property disputes or voided sales.

- Fraudulent Transactions: Unlicensed operators may engage in outright fraud, selling properties they don’t own, misrepresenting property conditions, or forging documents.

- Lack of Professional Standards: Licensed agents adhere to a strict code of ethics and professional conduct. Unlicensed individuals are not bound by these standards, making them prone to unethical practices.

The legal landscape surrounding unlicensed real estate activities is designed to deter such practices, but it primarily protects the public by punishing offenders rather than directly recovering consumer losses. Victims often face lengthy and expensive legal battles with limited guarantees of restitution.

How to Verify Real Estate Agent Credentials

Verifying a real estate agent’s credentials is the single most effective step you can take to protect yourself from the dangers of unlicensed real estate activity. This process is straightforward and should be a non-negotiable part of your due diligence before engaging any professional in a property transaction. Every state in the U.S. maintains a public database of licensed real estate professionals, making verification accessible to everyone.

The key is to use official sources and cross-reference information. Do not rely solely on business cards, websites, or verbal assurances. A legitimate agent will be transparent about their licensing information and will not hesitate to provide it or direct you to the official verification channels. Taking a few minutes to confirm their status can save you from immense financial and legal headaches down the line.

Steps for Verifying Credentials

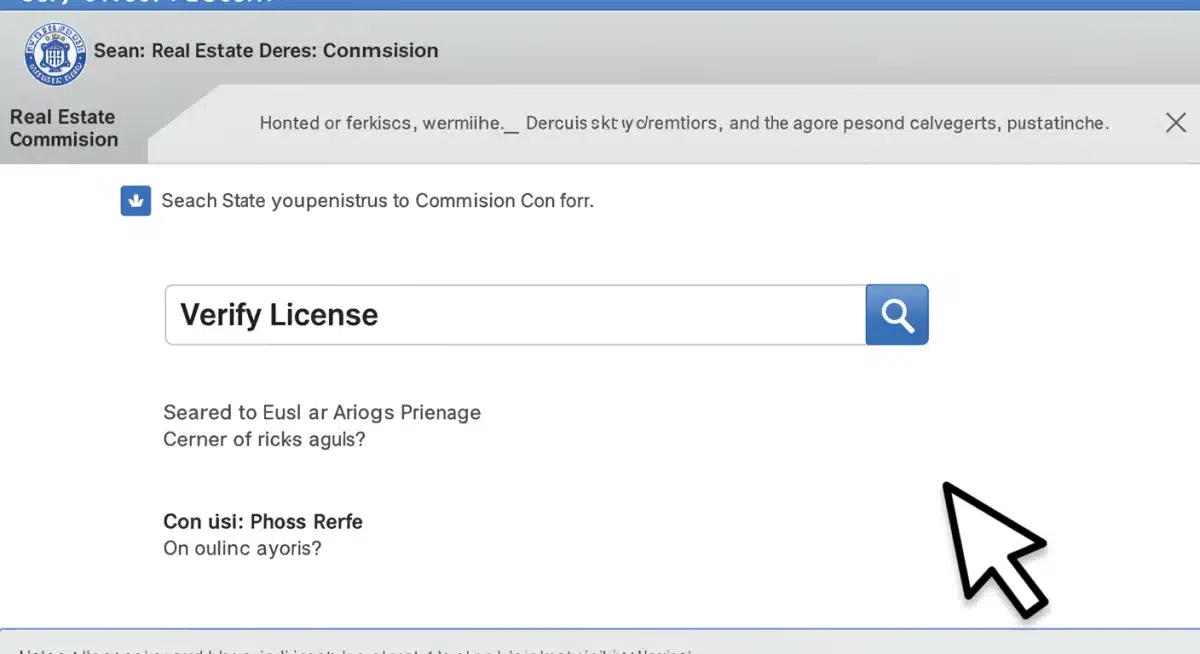

- Check State Licensing Boards: Every state has a Real Estate Commission or Department of Real Estate. Visit their official website and use their license lookup tool. You will typically need the agent’s name or license number.

- Confirm Active Status: Ensure the license is not only valid but also active. Licenses can be suspended, revoked, or expired.

- Verify Broker Affiliation: Licensed agents must operate under a licensed broker. Confirm that the agent is affiliated with a legitimate brokerage firm, and verify the broker’s license as well.

- Review Disciplinary Actions: State licensing boards often list any disciplinary actions taken against an agent or broker. This provides insight into their professional history and any past misconduct.

These verification steps are crucial for both buyers and sellers. For buyers, it ensures that the person representing them is qualified to navigate complex negotiations and legal documents. For sellers, it guarantees that their property is being marketed and sold by someone legally authorized to do so, protecting them from potential liabilities and ensuring a legitimate sale process.

Identifying Red Flags in Real Estate Transactions

Beyond verifying credentials, being attuned to certain red flags can significantly enhance your protection against unlicensed real estate dangers. Unlicensed operators often exhibit behaviors or make requests that deviate from standard professional practices. Recognizing these warning signs early can prompt you to investigate further or disengage from a potentially problematic situation before you incur losses.

Trust your instincts. If something feels off, or if an offer seems too good to be true, it likely is. A legitimate real estate transaction involves transparency, clear communication, and adherence to established legal and ethical guidelines. Any deviation from these norms should be a cause for concern and immediate investigation.

Common Warning Signs of Unlicensed Activity

- No License Information Provided: An agent who is vague about their license number or refuses to provide it upon request is a major red flag.

- Requests for Cash Payments: Legitimate real estate transactions rarely involve large cash payments, especially for deposits or fees directly to an individual.

- Unusual Payment Methods: Be wary of requests to wire money to personal accounts or use non-traceable payment methods.

- Pressure Tactics: High-pressure sales tactics, demands for quick decisions without adequate time for review, or discouragement from seeking legal advice are warning signs.

- Lack of Formal Contracts: Unlicensed individuals may try to conduct business with informal agreements, avoiding legally binding contracts.

- Exaggerated Claims or Guarantees: Promises of unrealistic returns or guaranteed outcomes without any risk should be viewed with skepticism.

- Refusal to Show Proper Identification: A legitimate agent should always be willing to provide professional identification and contact information for their brokerage.

These red flags are not always definitive proof of fraud, but they warrant extreme caution. Always prioritize your safety and financial security by pausing the transaction and seeking independent verification or legal counsel if any of these signs appear. Being proactive and informed is your best defense against falling victim to unlicensed real estate activity.

Reporting Unlicensed Real Estate Activity

If you suspect or confirm that someone is engaging in unlicensed real estate activity, it is crucial to report them to the appropriate authorities. Reporting not only protects you from potential fraud but also prevents others from becoming victims. State real estate commissions and consumer protection agencies rely on public vigilance to identify and prosecute individuals operating outside the law, reinforcing the integrity of the real estate market.

The process of reporting is designed to be accessible, though it requires gathering specific information to support your claim. Your report contributes to a safer marketplace for everyone, ensuring that only qualified and licensed professionals handle property transactions. Do not hesitate to act if you encounter suspicious behavior; your diligence can make a significant difference.

Where and How to File a Report

- State Real Estate Commission: The primary body to contact is your state’s Real Estate Commission or Department of Real Estate. Their websites usually have a dedicated section for filing complaints against unlicensed individuals.

- Attorney General’s Office: Your state’s Attorney General’s office also handles consumer fraud complaints and can investigate cases of unlicensed activity.

- Local Law Enforcement: In cases where financial fraud or theft is evident, reporting to local law enforcement is also necessary.

When filing a report, provide as much detail as possible. This includes the individual’s name, contact information, specific dates and times of interactions, copies of any communications (emails, texts), and any documents or contracts exchanged. Documenting everything thoroughly strengthens your case and aids the authorities in their investigation. Remember, timely reporting increases the chances of successful intervention and remediation.

Protecting Yourself: Best Practices for Consumers

Navigating the real estate market requires diligence, and proactive measures are your strongest shield against the dangers of unlicensed real estate activity. Adopting a set of best practices ensures that every step of your property transaction is handled by legitimate professionals, safeguarding your investment and peace of mind. These practices extend beyond initial verification to encompass ongoing vigilance throughout the entire process.

The goal is to minimize your exposure to risk by engaging only with verified, reputable entities and understanding the standard procedures of real estate transactions. This empowered approach helps you identify deviations and respond effectively, ensuring a secure and legally sound experience.

Essential Consumer Protection Strategies

- Always Verify Licenses: Make it a habit to check the license status of any real estate professional you consider working with, regardless of how they were referred to you.

- Use Licensed Escrow Services: Ensure all funds, especially earnest money, are held in a neutral, licensed escrow account, not directly by an agent or individual.

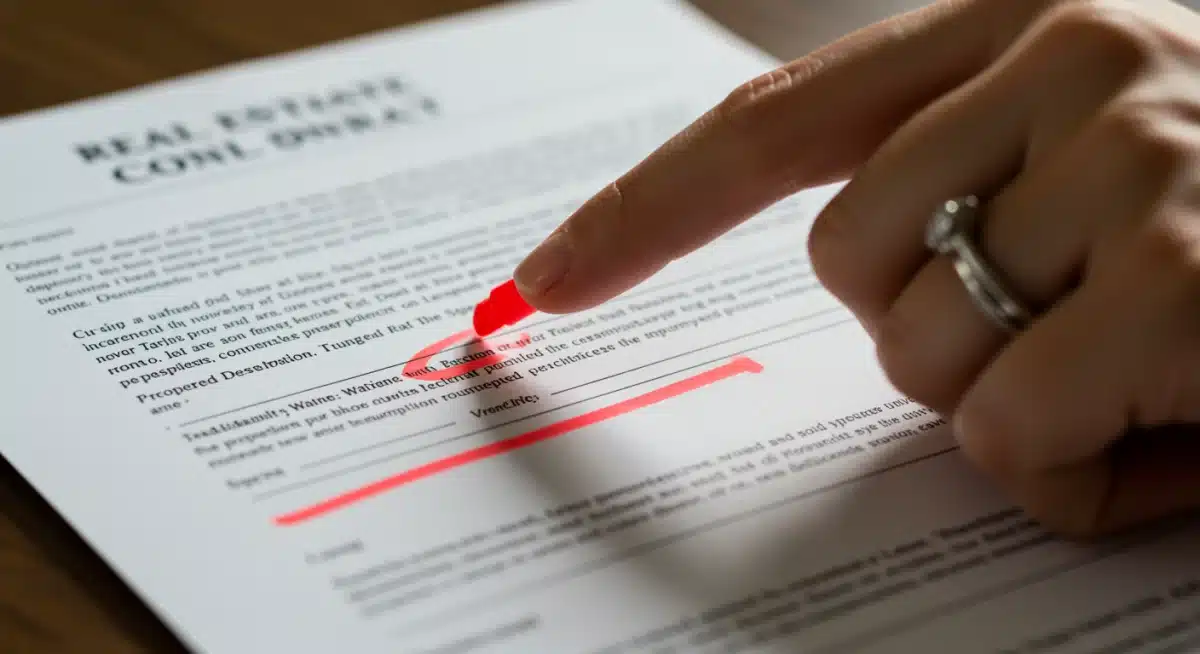

- Obtain Written Contracts: Insist on formal, written contracts for all agreements, and have them reviewed by an independent attorney before signing.

- Avoid Pressure: Do not succumb to pressure to make quick decisions or waive due diligence steps. A legitimate transaction allows time for careful consideration.

- Seek Legal Counsel: For complex transactions or if you have any doubts, consult with a real estate attorney. They can provide impartial advice and review documents.

- Educate Yourself: Understand the basic steps and legal requirements of buying or selling property in your state. Knowledge is a powerful defense.

By consistently applying these best practices, consumers can significantly reduce their vulnerability to the dangers associated with unlicensed real estate activity. These measures collectively build a robust framework of protection, ensuring your real estate journey is as smooth and secure as possible.

The Role of Regulatory Bodies in Consumer Protection

Regulatory bodies play a pivotal role in curbing the dangers of unlicensed real estate activity by setting standards, enforcing laws, and providing avenues for consumer recourse. These state-level entities are the front line of defense against fraud and misconduct, working tirelessly to maintain the integrity of the real estate profession. Their existence is a testament to the complex nature of property transactions and the necessity of safeguarding public interests.

Understanding the functions of these bodies empowers consumers to leverage their oversight capabilities. From licensing and education to investigation and disciplinary action, these commissions ensure that real estate professionals adhere to a strict code of conduct, thereby offering a layer of protection that unlicensed individuals simply cannot provide.

Functions of State Real Estate Commissions

- Licensing and Certification: They establish and enforce educational, experience, and examination requirements for real estate licenses.

- Regulatory Oversight: They create and uphold regulations governing the conduct of licensed agents and brokers, ensuring ethical practices.

- Investigations and Enforcement: They investigate complaints against licensees and unlicensed individuals, taking disciplinary action where necessary.

- Consumer Education: Many commissions offer resources and information to help consumers understand their rights and responsibilities in real estate transactions.

- Maintaining Public Records: They keep publicly accessible databases of licensed professionals and disciplinary actions, crucial for verification.

These commissions are not merely bureaucratic entities; they are active protectors of consumer rights. Their robust regulatory frameworks deter illicit activities and provide a clear pathway for consumers to seek justice when harmed. Engaging with licensed professionals means you are operating within a system designed to protect you, backed by the authority and enforcement power of the state.

Key Point |

Brief Description |

|---|---|

Unlicensed Activity |

Performing real estate services without a valid state license, leading to legal and financial risks for consumers. |

Verification Steps |

Check state licensing board websites for active license status, broker affiliation, and disciplinary records. |

Red Flags |

Lack of license info, cash requests, unusual payments, high pressure, and absence of formal contracts. |

Reporting |

Report suspicious activity to state real estate commissions, Attorney General, or local law enforcement. |

Frequently Asked Questions About Unlicensed Real Estate

The primary risks include financial losses due to fraud, misappropriated funds, and unenforceable contracts. You also lose the protection of state regulatory bodies and professional insurance, leaving little recourse in case of misconduct or errors by the agent.

You can verify an agent’s license by visiting your state’s official Real Estate Commission or Department of Real Estate website. Look for a license lookup tool where you can enter the agent’s name or license number to confirm their active status and disciplinary history.

This is a significant red flag. Legitimate real estate transactions rarely involve large cash payments or requests to wire money to personal accounts. Immediately stop the transaction, verify their credentials independently, and consider reporting the individual to authorities.

Contracts brokered by unlicensed real estate agents may be deemed unenforceable or void by courts. This can lead to significant legal complications, property disputes, or the loss of deposits, highlighting the importance of working with licensed professionals.

You should report suspected unlicensed activity to your state’s Real Estate Commission or Department of Real Estate. Additionally, you can contact your state’s Attorney General’s office or local law enforcement, especially if financial fraud is involved.

What This Means for Consumers

The prevalence of unlicensed real estate dangers underscores a critical need for heightened consumer awareness and proactive protection. This information means that vigilance is not just advisable, but essential for anyone engaging in property transactions. By diligently verifying credentials, recognizing red flags, and understanding the avenues for reporting, consumers can significantly mitigate risks. Moving forward, the emphasis remains on informed decision-making and leveraging the robust regulatory frameworks in place to ensure secure and legitimate real estate dealings for all.