Supply Chain Disruptions & New Home Construction 2025 Updates

The Impact of Supply Chain Disruptions on New Home Construction in 2025 (RECENT UPDATES) remains a critical concern for builders, buyers, and policymakers alike. As of early [Current Month, Current Year], new data and expert analyses continue to underscore the persistent challenges facing the housing sector. Will the market find stability, or are further hurdles on the horizon?

Understanding the Current State of Supply Chains

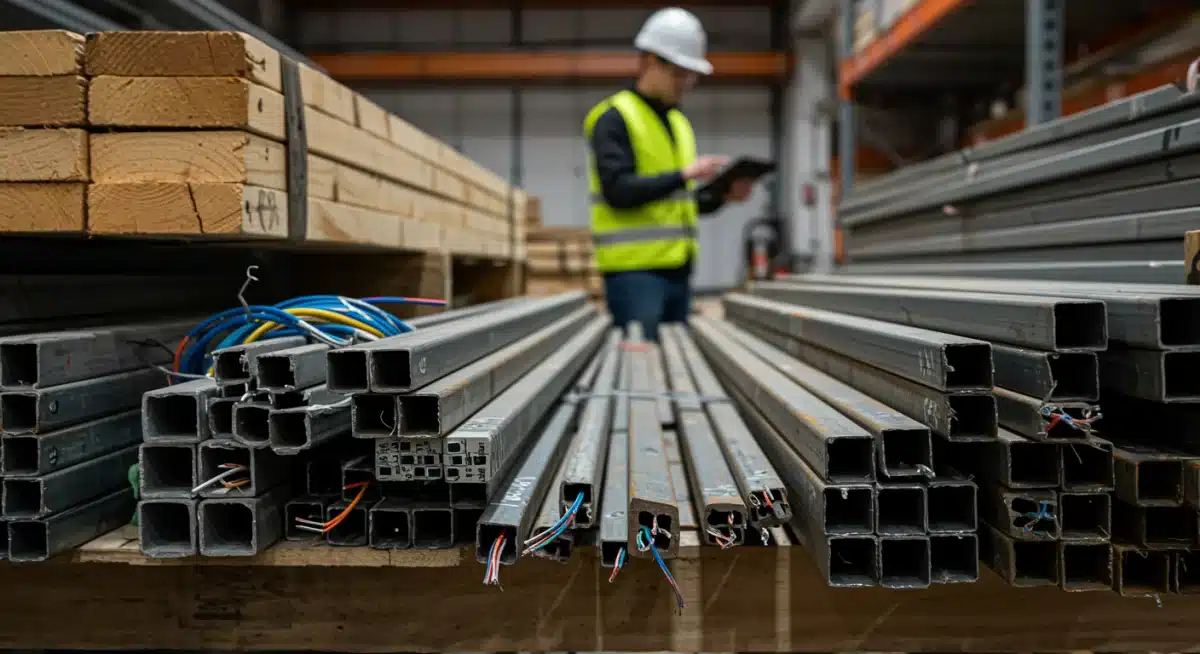

The global supply chain, a complex web of production, logistics, and distribution, continues to experience significant volatility. This instability directly affects the availability and cost of essential materials needed for new home construction. Builders are reporting ongoing issues that stretch beyond mere delays, now impacting project viability.

Recent reports, including those from the National Association of Home Builders (NAHB) as of [Recent Date, e.g., March 15, 2024], indicate that while some bottlenecks have eased, new ones emerge. Geopolitical tensions, labor shortages, and fluctuating energy prices are converging to create an unpredictable environment for material sourcing. This situation forces builders to adapt quickly, often at increased costs.

Key Material Shortages Persist

Several critical construction materials are still experiencing significant supply constraints. These shortages are not uniform across all regions but represent a widespread issue that complicates planning and execution for new housing projects.

- Lumber and Wood Products: Despite some stabilization, prices can still spike due to regional demand shifts or unexpected mill closures.

- Electrical Components: Microchip shortages and specialized wiring remain difficult to procure, delaying installations.

- HVAC Systems: Demand outstrips supply for many energy-efficient heating, ventilation, and air conditioning units.

- Plumbing Fixtures: Specific components and finishes are subject to longer lead times from international manufacturers.

Economic Pressures and Material Costs in 2025

The economic landscape in 2025 continues to exert considerable pressure on the new home construction sector. Inflationary pressures, while showing signs of moderation in some areas, are still a major factor influencing material costs. This directly translates into higher construction expenses, which are then passed on to prospective homebuyers, impacting affordability.

According to recent economic forecasts from [Reputable Economic Institute, e.g., the International Monetary Fund] released last month, global manufacturing output is projected to grow modestly, yet regional disruptions could still trigger price volatility. Builders are particularly concerned about the cost of fossil fuels, which directly impacts transportation costs for materials, and the manufacturing processes for many building components like plastics and insulation.

Furthermore, labor costs are also escalating. A tight labor market for skilled trades means higher wages, adding another layer of expense to each new home. These combined economic pressures create a challenging environment where developers must meticulously manage budgets to remain competitive.

Labor Shortages: A Growing Bottleneck

Beyond material concerns, the new home construction industry faces an intensifying challenge: a severe shortage of skilled labor. This issue, which predates recent supply chain disruptions, is now exacerbated, creating a significant bottleneck in project completion timelines.

Reports from construction industry associations, such as the Associated General Contractors of America (AGC) in their latest workforce survey, highlight that nearly 80% of construction firms are struggling to find qualified workers. This includes carpenters, electricians, plumbers, and HVAC technicians. The aging workforce, coupled with a lack of new entrants into the trades, is creating a demographic gap that is difficult to fill quickly.

Impact on Project Timelines and Quality

The scarcity of skilled labor has direct and significant consequences for new home construction.

- Extended Completion Times: Projects take longer to finish, delaying occupancy and increasing carrying costs for builders.

- Increased Labor Costs: Higher wages and incentives are often necessary to attract and retain skilled workers, driving up overall construction expenses.

- Potential Quality Issues: A rush to complete projects with less experienced staff can sometimes lead to compromises in workmanship, though reputable builders strive to mitigate this.

- Reduced Housing Output: Fewer homes can be built annually if the workforce capacity is limited, contributing to housing supply shortages.

Technological Innovations and Adaptations

In response to persistent supply chain and labor challenges, the new home construction industry is increasingly turning to technological innovations and adaptive strategies. These approaches aim to streamline processes, reduce waste, and mitigate the impact of external disruptions. Builders are exploring everything from advanced planning software to modular construction techniques.

For instance, the adoption of Building Information Modeling (BIM) software is becoming more widespread. BIM allows for highly detailed 3D models of projects, enabling better coordination between trades, earlier identification of potential conflicts, and more accurate material ordering. This can significantly reduce material waste and rework, which are costly and time-consuming in a disrupted supply environment.

Modular and Prefabricated Construction Gains Traction

One of the most promising adaptations is the increased use of modular and prefabricated construction methods. By assembling components or entire sections of homes in a controlled factory environment, builders can:

- Reduce On-Site Labor Needs: Factory work requires a different skill set and can be more efficient, alleviating some pressure on traditional skilled trades.

- Improve Quality Control: Consistent factory conditions lead to higher precision and fewer defects.

- Accelerate Project Timelines: Modules can be produced concurrently with site preparation, significantly cutting down overall construction duration.

- Minimize Material Waste: Optimized cutting and assembly in a factory setting reduce scrap and material loss.

While still a niche market, its growth is undeniable as the industry seeks resilient solutions against ongoing disruptions.

Government Policies and Industry Responses

Governments worldwide are recognizing the profound impact of supply chain disruptions on housing affordability and availability. As a result, various policy responses are emerging, alongside proactive strategies from the construction industry itself. These efforts aim to stabilize the market and foster a more resilient housing sector.

In the United States, for example, the Department of Commerce has initiated programs to monitor key material flows and identify potential bottlenecks early. Additionally, some states are offering incentives for local production of building materials, aiming to reduce reliance on international supply chains. These measures, while still in early stages, signal a growing commitment to addressing the root causes of current market instability.

The industry, on its part, is forming stronger partnerships with suppliers, often engaging in long-term contracts to secure material availability and pricing. Diversification of sourcing strategies is also a priority, with builders looking beyond traditional suppliers to mitigate risks associated with concentrated supply bases. Furthermore, advocacy groups are actively lobbying for greater investment in vocational training programs to address the critical labor shortage.

Outlook for New Home Construction in 2025

The outlook for new home construction in 2025 remains complex, marked by both persistent challenges and emerging opportunities. While the immediate future suggests continued navigation of supply chain volatility and labor constraints, there is also a growing emphasis on innovation and strategic adaptation. The housing market is not expected to return to pre-pandemic norms quickly, but rather evolve into a more resilient, albeit different, operational landscape.

Analysts from major financial institutions, such as [Prominent Financial Analyst Firm, e.g., Moody’s Analytics] in their latest housing report, project that while housing starts may see modest growth, the pace will largely depend on the resolution of existing supply chain issues and the effectiveness of new policy interventions. Affordability will remain a key concern, with prices continuing to be impacted by material and labor costs. However, the increased adoption of modular construction and other efficiencies could provide some relief by reducing overall build times and waste.

Ultimately, success in 2025 will hinge on the industry’s ability to remain agile, embrace new technologies, and foster stronger, more localized supply networks. Collaboration between builders, suppliers, and policymakers will be crucial in shaping a more stable and productive environment for new home construction.

| Key Point | Brief Description |

|---|---|

| Material Shortages | Lumber, electrical components, and HVAC systems remain difficult to procure, delaying projects. |

| Labor Deficit | A severe lack of skilled workers extends timelines and increases construction costs. |

| Economic Pressures | Inflation and high transportation costs continue to elevate overall building expenses. |

| Technological Adaptations | Modular construction and BIM software are being adopted to mitigate disruptions. |

Frequently Asked Questions About 2025 Home Construction

Key materials such as lumber, electrical components, HVAC systems, and certain plumbing fixtures continue to experience supply constraints. These shortages are often due to a combination of geopolitical factors, manufacturing backlogs, and increased demand in a recovering market.

Labor shortages significantly extend project completion times. With fewer skilled carpenters, electricians, and plumbers available, builders face delays in every stage of construction, leading to increased carrying costs and postponed occupancy dates for new homeowners.

Inflation directly contributes to higher new home costs by increasing prices for raw materials, manufacturing processes, and transportation. These elevated expenses are ultimately passed on to consumers, impacting the overall affordability and accessibility of new housing units.

Yes, technologies like Building Information Modeling (BIM) and modular construction are proving effective. BIM improves planning and reduces waste, while modular methods shift production to controlled factory environments, mitigating on-site labor and material challenges, thus speeding up construction.

Governments are implementing measures such as monitoring critical material flows, offering incentives for domestic material production, and investing in vocational training programs. These initiatives aim to stabilize supply chains, reduce reliance on imports, and address the persistent skilled labor deficit in the construction industry.

What Happens Next

As 2025 progresses, the new home construction sector will keenly watch for signs of sustained improvement in global supply chains and labor markets. The effectiveness of government policies aimed at localized production and workforce development will be crucial. Buyers should anticipate continued market adjustments while the industry adapts to these new realities, favoring builders who embrace resilience and innovation. Further updates on material availability and economic indicators are expected to shape the trajectory of housing starts and affordability in the coming months.