Property Value Appreciation: Analyzing Last 12 Months’ Data

Property value appreciation over the last 12 months shows varied trends across regions, influenced by inflation, interest rates, and housing supply dynamics, impacting both buyers and sellers significantly.

Understanding the current landscape of property value appreciation is crucial for homeowners, prospective buyers, and investors. Over the last 12 months, the real estate market has navigated a complex economic environment, leading to diverse outcomes across different regions and property types.

National Overview of Property Value Appreciation

The national housing market has experienced a dynamic period over the past year, with overall property value appreciation continuing, albeit at a moderated pace compared to the pandemic-era surge. As of recent data, the median home value has shown a steady increase, reflecting persistent demand in many areas.

According to the latest reports from leading real estate analytics firms, the average national home value saw an increase of approximately 3.5% to 5.0% in the last 12 months, as of early June 2024. This growth is a testament to the underlying strength of the market, even amidst higher interest rates and economic uncertainties.

Key Drivers of National Growth

Several factors have collectively contributed to the national property value appreciation. These include a continued shortage of housing inventory, particularly in desirable urban and suburban areas, and a resilient job market that supports buying power.

- Limited Inventory: New construction has struggled to keep pace with demand, creating a supply-demand imbalance that pushes prices upward.

- Strong Job Market: Consistent employment growth and rising wages have bolstered consumer confidence and their ability to afford homeownership.

- Demographic Shifts: Millennial and Gen Z buyers are increasingly entering the housing market, driving demand for starter homes and family residences.

- Inflationary Pressures: While interest rates have impacted affordability, inflation has also driven up the cost of construction and existing homes, contributing to value increases.

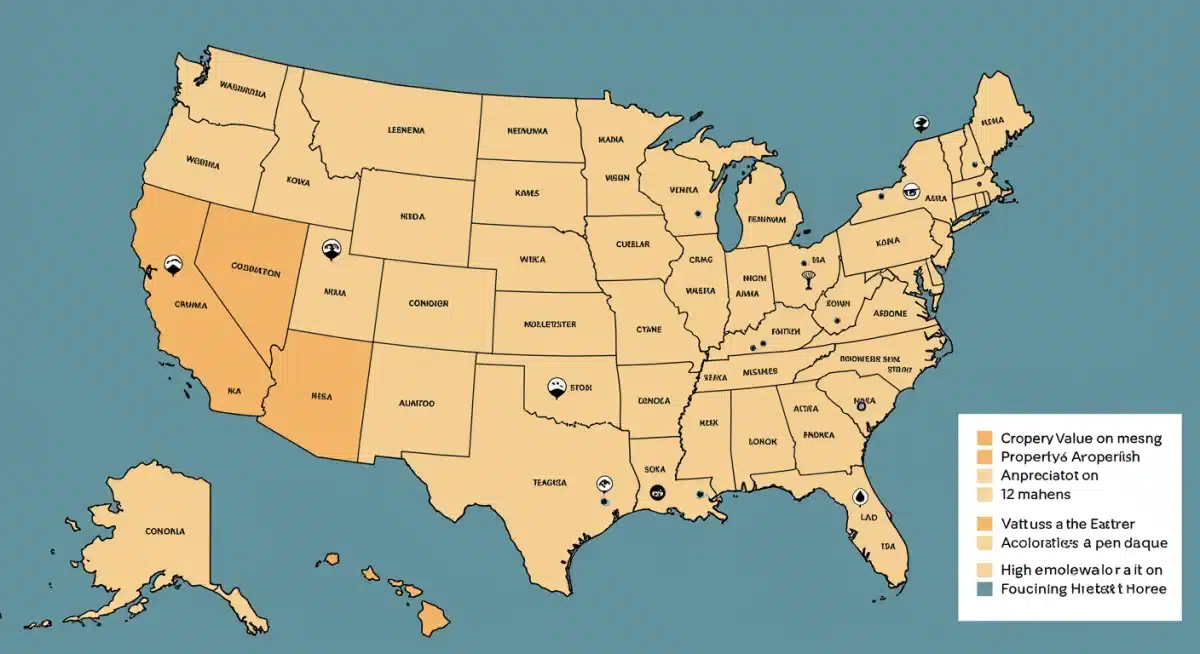

Regional Disparities in Market Performance

While the national picture shows overall growth, a closer look reveals significant regional disparities in property value appreciation. Some markets have seen robust gains, while others have experienced more modest increases or even slight corrections. This divergence is primarily driven by local economic conditions, population shifts, and housing supply.

For instance, states in the Southeast and Mountain West regions have generally outperformed the national average, attracting new residents and businesses. Conversely, some West Coast markets, which saw exponential growth in previous years, have experienced a cooling period.

Top Performing Regions

Certain metropolitan areas have consistently led in property value appreciation. These regions often boast strong local economies, diverse job markets, and a high quality of life that attracts new residents.

- Florida: Cities like Miami and Tampa continue to see strong appreciation, fueled by inbound migration and a favorable tax environment.

- Texas: Austin and Dallas-Fort Worth remain hotbeds for growth, driven by tech industry expansion and corporate relocations.

- Carolinas: Raleigh and Charlotte have also demonstrated significant gains, benefiting from a growing population and robust employment opportunities.

Underperforming Markets

Some markets have faced headwinds, resulting in slower appreciation or slight dips. These areas are often grappling with affordability challenges, higher inventory levels, or local economic contractions.

For example, some markets in California, such as San Francisco and San Jose, have seen more tempered growth, partially due to very high existing home prices and a recent outflow of residents seeking more affordable living. Similarly, certain Midwestern cities with stagnant population growth have experienced less dynamic market conditions.

Impact of Interest Rates and Inflation

Interest rates and inflation have played a pivotal role in shaping property value appreciation over the past 12 months. The Federal Reserve’s aggressive rate hikes to combat inflation have directly impacted mortgage rates, influencing buyer affordability and market dynamics.

Higher mortgage rates have effectively reduced purchasing power for many potential buyers, leading to a decrease in transaction volumes in some areas. However, the impact on property values has been cushioned by persistent demand and limited supply, preventing a widespread downturn.

Affordability Challenges

The combination of elevated home prices and higher interest rates has created significant affordability challenges across the nation. This has particularly affected first-time homebuyers, who often struggle to save for down payments and qualify for larger loans.

- Reduced Purchasing Power: A higher interest rate means a larger monthly mortgage payment for the same loan amount, forcing some buyers to seek smaller or less expensive homes.

- Increased Cost of Ownership: Beyond the mortgage, inflation has also driven up property taxes, homeowners insurance, and maintenance costs, adding to the overall burden of homeownership.

Analyzing Housing Inventory Trends

Housing inventory remains a critical factor influencing property value appreciation. Over the last 12 months, the supply of available homes for sale has generally remained low, contributing to competitive bidding and sustained price growth in many markets.

While there have been slight increases in inventory in some regions, particularly in markets experiencing a cooling trend, the overall national picture still points to a seller’s market. Many homeowners with low fixed-rate mortgages are reluctant to sell, fearing they will have to purchase a new home at a much higher rate.

New Construction and Supply

New home construction has shown some signs of recovery but continues to face challenges. Labor shortages, high material costs, and supply chain disruptions have slowed the pace of building, exacerbating the existing housing deficit.

According to recent housing starts data, while there’s an uptick in multi-family unit construction, single-family home building still lags behind pre-pandemic levels. This ongoing supply constraint ensures that even with fluctuating demand, existing home values are likely to hold firm or continue to appreciate.

Future Outlook for Property Values

Looking ahead, the trajectory of property value appreciation will likely depend on a delicate balance of economic factors. Experts predict a continued moderation in price growth, rather than a significant decline, as the market adjusts to current conditions.

Interest rates are expected to stabilize, potentially offering some relief to buyers in the coming months. However, housing inventory is not projected to rebound dramatically in the short term, suggesting that supply-side pressures will continue to support values.

Expert Predictions and Market Forecasts

Real estate analysts anticipate a more balanced market in the latter half of 2024 and into 2025. While bidding wars may become less common, strong demand in key areas will likely prevent widespread depreciation.

- Moderated Growth: National property value appreciation is expected to settle into a more sustainable range of 2-4% annually.

- Regional Variation Persists: Local market conditions will continue to dictate performance, with some areas seeing stronger growth than others.

- Affordability Remains Key: The ability of buyers to afford homes will be a primary determinant of market activity and price trends.

Strategies for Buyers and Sellers in the Current Market

Navigating the current real estate market requires strategic thinking for both buyers and sellers, given the ongoing trends in property value appreciation. Understanding these dynamics can help individuals make informed decisions.

For buyers, patience and thorough research are paramount. Exploring different neighborhoods, considering various property types, and securing pre-approval for a mortgage can provide a competitive edge. For sellers, strategic pricing and effective marketing are crucial to maximize value.

Advice for Potential Buyers

In a market characterized by still-strong values and fluctuating interest rates, buyers should focus on long-term goals and financial readiness.

- Get Pre-Approved: This clarifies your budget and signals seriousness to sellers.

- Be Flexible: Consider properties that might need minor updates or are slightly outside your preferred area to find better value.

- Monitor Rates: Keep an eye on interest rate trends and be prepared to act when conditions are favorable.

Tips for Home Sellers

Sellers can still command good prices, especially in high-demand markets, but need to be realistic about pricing and presentation.

- Strategic Pricing: Price your home competitively based on recent comparable sales in your area, not just aspirational figures.

- Enhance Curb Appeal: First impressions matter. Invest in minor repairs and landscaping to attract more buyers.

- Professional Staging: A well-staged home can highlight its best features and help buyers envision themselves living there.

| Key Point | Brief Description |

|---|---|

| National Appreciation | Overall property values increased by 3.5% to 5.0% nationally over the last 12 months, showing moderation. |

| Regional Disparities | Growth varied significantly, with Southeast and Mountain West outperforming, while some West Coast markets cooled. |

| Interest Rates & Inflation | Higher rates reduced affordability, but persistent demand and limited supply cushioned value impact. |

| Housing Inventory | Low housing supply remains a key factor, sustaining competitive bidding and price growth in many areas. |

Frequently Asked Questions About Property Value Appreciation

Property value appreciation is primarily driven by supply and demand dynamics, local economic growth, interest rates, population shifts, and inflation. Strong job markets and limited housing inventory typically lead to higher appreciation rates.

Higher interest rates have generally reduced buyer purchasing power, leading to fewer transactions and a moderation in price growth. However, persistent demand and low inventory in many markets have prevented significant value declines.

Over the last 12 months, regions in the Southeast (e.g., Florida, Carolinas) and Mountain West (e.g., Texas) have generally exhibited the highest property value appreciation, fueled by robust economic growth and inbound migration.

Experts anticipate a continued moderation in property value appreciation rather than a significant cooldown. While growth may slow, strong underlying demand and limited inventory are expected to support values in most markets.

Sellers should focus on strategic pricing based on comparable sales, enhancing curb appeal, and professional staging to attract buyers. Understanding local market conditions is key to maximizing sale value.

Looking Ahead: What Happens Next

The current trends in property value appreciation indicate a market in transition, moving towards a more normalized state after years of unprecedented growth. While the rapid increases of the past are likely behind us, sustained demand and ongoing supply constraints suggest that home values will continue to appreciate, albeit at a more gradual and sustainable pace. Investors and homeowners should remain attentive to regional economic shifts and evolving interest rate policies, as these will be critical determinants of market performance in the coming months.