Investor Alert: Q4 2024 High-Growth Areas Revealed

This investor alert reveals critical high-growth areas identified through comprehensive Q4 2024 data analysis, offering time-sensitive insights for strategic investment decisions and maximizing returns in emerging markets and sectors.

An urgent Investor Alert: Identifying High-Growth Areas Based on Q4 2024 Data (TIME-SENSITIVE) is now live, as new market intelligence pinpoints critical sectors and geographies poised for significant expansion. Investors must act swiftly to capitalize on these emerging opportunities, driven by robust economic indicators and evolving global dynamics.

Emerging Market Dynamics in Q4 2024

The final quarter of 2024 has unveiled a complex yet opportunity-rich landscape across global markets. Key economic indicators, including GDP growth rates and consumer spending habits, have shown surprising resilience in certain regions, defying earlier predictions of widespread slowdowns. This divergence underscores the importance of granular data analysis for identifying true growth potential.

Several factors are converging to reshape investment narratives. Supply chain optimizations, coupled with advancements in automation, are driving efficiency gains in manufacturing hubs. Additionally, shifts in geopolitical alignments are creating new trade corridors and fostering regional economic blocs, presenting unique entry points for discerning investors.

Technological Innovation as a Catalyst

Technological innovation remains a primary engine for growth, particularly in areas like artificial intelligence, quantum computing, and advanced materials. Companies at the forefront of these fields are demonstrating exponential revenue growth and expanding market share. This trend is not confined to established tech giants; numerous startups are also attracting significant venture capital, signaling future market leaders.

- AI Integration: Widespread adoption across industries, from healthcare to logistics.

- Sustainable Tech: Renewable energy solutions and green infrastructure projects gaining momentum.

- Biotech Breakthroughs: Advances in gene editing and personalized medicine attracting major funding.

These technological leaps are not just about new products; they are fundamentally altering business models and consumer expectations, creating fertile ground for long-term investment. The impact is visible in both developed and developing economies, albeit with varying degrees of adoption and regulatory frameworks.

Geographic Hotspots for Investment

Q4 2024 data highlights specific geographic regions exhibiting exceptional growth potential. These areas are characterized by a combination of favorable regulatory environments, skilled labor pools, and significant infrastructure investments. Understanding these regional nuances is paramount for strategic asset allocation.

Southeast Asia, for instance, continues its robust economic expansion, fueled by a young, digitally-savvy population and increasing foreign direct investment. Countries like Vietnam and Indonesia are particularly attractive, offering competitive manufacturing costs and rapidly expanding consumer markets. Latin America is also showing pockets of strong performance, especially in countries investing heavily in digital infrastructure and resource extraction.

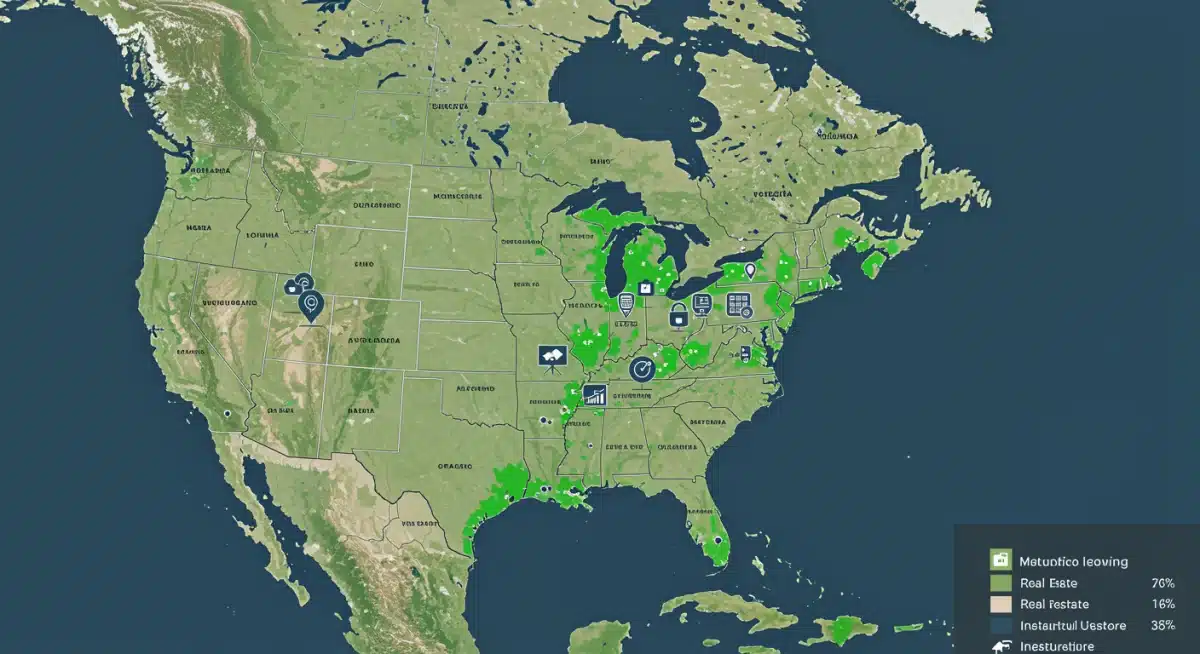

North American Resurgence

In North America, certain metropolitan areas are experiencing a renaissance, driven by tech sector expansion and a return to urban centers. Austin, Miami, and Raleigh-Durham are leading this charge, attracting both talent and capital. These cities benefit from strong university ecosystems and supportive local governments, fostering innovation and entrepreneurship.

- Texas: Energy, technology, and manufacturing sectors are booming.

- Florida: Sustained growth in tourism, finance, and tech migration.

- North Carolina: Strong biotech and research clusters attracting investment.

These regional strongholds are creating localized economic engines that are less susceptible to broader national economic fluctuations, offering a degree of insulation for targeted investments. The influx of skilled workers further solidifies their long-term growth prospects.

Sector-Specific Opportunities and Risks

Delving deeper into Q4 2024 data reveals distinct opportunities and inherent risks across various economic sectors. While technology and renewable energy continue to dominate headlines, other sectors are quietly demonstrating significant upside. Investors must balance potential gains with a thorough understanding of sector-specific challenges.

The healthcare sector, particularly areas focusing on preventative care and digital health solutions, is experiencing accelerated growth. An aging global population and increased health consciousness are driving demand for innovative services and products. Conversely, traditional retail and fossil fuel industries face ongoing headwinds, necessitating careful due diligence and a long-term perspective on sustainability.

Renewable Energy and Sustainability

The push towards sustainability is creating unprecedented investment opportunities in renewable energy. Solar, wind, and geothermal projects are attracting massive capital infusions, supported by government incentives and growing consumer demand for clean energy. Battery storage technology and electric vehicle infrastructure are also critical components of this green transition.

- Solar Power: Decreasing costs and efficiency improvements driving adoption.

- Wind Energy: Offshore wind farms expanding rapidly, offering large-scale power generation.

- EV Infrastructure: Charging networks and battery production scaling up to meet demand.

However, regulatory changes and supply chain dependencies for critical minerals present ongoing risks in this sector. Geopolitical tensions can impact the availability and cost of materials, requiring investors to diversify their portfolios and consider resilient supply chain strategies.

Understanding Market Volatility and Mitigation

Despite promising growth areas, Q4 2024 also exhibited periods of heightened market volatility. Geopolitical tensions, inflation concerns, and interest rate adjustments continue to influence investor sentiment and market performance. Understanding these dynamics is crucial for mitigating risks and protecting capital.

The Federal Reserve’s stance on monetary policy, coupled with central bank actions globally, directly impacts liquidity and borrowing costs, which in turn affect corporate profitability and investment attractiveness. Investors are closely monitoring inflation reports and employment figures for clues about future policy directions, as reported by financial analysts. This vigilance allows for proactive portfolio adjustments.

Diversification as a Key Strategy

Diversification remains a cornerstone of prudent investment in volatile markets. Spreading investments across different asset classes, sectors, and geographic regions can help cushion portfolios against unexpected downturns in specific areas. This strategy is particularly relevant when navigating the time-sensitive opportunities presented by Q4 2024 data.

- Asset Classes: Balance equities, bonds, real estate, and commodities.

- Sector Exposure: Avoid over-concentration in any single high-growth sector.

- Geographic Spread: Invest in both developed and emerging markets to reduce regional risk.

Furthermore, maintaining a long-term investment horizon can help weather short-term market fluctuations. While the allure of quick gains from high-growth areas is strong, a patient and disciplined approach often yields more sustainable returns over time, according to veteran fund managers.

Leveraging Data Analytics for Investment Decisions

In the current fast-paced market environment, advanced data analytics has become indispensable for identifying and validating high-growth investment opportunities. Q4 2024 data is not merely a collection of numbers; it represents actionable intelligence when processed and interpreted correctly. Investors are increasingly relying on sophisticated tools and expert analysis to gain an edge.

Predictive modeling, machine learning algorithms, and real-time market sentiment analysis are transforming how investment decisions are made. These technologies can process vast amounts of data, identify subtle patterns, and forecast future trends with a higher degree of accuracy than traditional methods. This allows for more informed and timely responses to market shifts, crucial for time-sensitive alerts.

The Role of Expert Analysis

While technology provides the tools, expert human analysis remains vital. Experienced analysts can provide context, interpret complex data sets, and identify qualitative factors that algorithms might miss. Their insights into geopolitical events, regulatory changes, and consumer behavior add a crucial layer of understanding to quantitative data.

- Trend Identification: Experts confirm emerging patterns flagged by data.

- Risk Assessment: Qualitative judgment on non-quantifiable risks.

- Strategic Guidance: Translating data into actionable investment strategies.

Combining robust data analytics with seasoned human expertise creates a powerful synergy, enabling investors to navigate the complexities of identifying High-Growth Areas Q4 2024 with greater confidence. This integrated approach minimizes blind spots and maximizes the potential for capturing lucrative opportunities.

Regulatory Landscape and Policy Impact

The regulatory landscape continues to play a significant role in shaping investment attractiveness, particularly within the high-growth areas identified in Q4 2024. Government policies, ranging from tax incentives to environmental regulations, can either accelerate or hinder sectoral development. Staying abreast of these changes is non-negotiable for investors seeking to optimize their portfolios.

In many emerging markets, governments are actively implementing policies to attract foreign investment, offering tax breaks and streamlined approval processes for projects in strategic sectors like renewable energy and digital infrastructure. Conversely, increased scrutiny and stricter regulations in other regions might introduce unforeseen challenges and compliance costs, impacting profitability.

Global Trade Agreements and Tariffs

The ongoing evolution of global trade agreements and the imposition of tariffs can significantly alter the competitive landscape for international businesses. Q4 2024 saw several critical trade negotiations impacting industries from manufacturing to agriculture. These agreements can open new markets or create barriers, directly influencing the viability of certain investments.

- Trade Bloc Formation: New regional agreements fostering intra-bloc trade.

- Tariff Adjustments: Impact on import/export costs and supply chain dynamics.

- Intellectual Property Rights: Strengthening protections in key technological sectors.

Investors must closely monitor these developments, as they can rapidly shift the economic calculus for various industries and regions. A proactive approach to understanding the regulatory environment allows for timely adjustments to investment strategies, especially when targeting time-sensitive opportunities.

| Key Point | Brief Description |

|---|---|

| Emerging Market Resilience | Certain global regions show surprising economic strength, driven by unique local factors. |

| Tech Sector Dominance | AI, biotech, and sustainable tech continue as primary growth engines for investments. |

| Geographic Hotspots | Southeast Asia and specific North American cities are identified as prime investment locations. |

| Data-Driven Decisions | Advanced analytics and expert insights are crucial for navigating market complexities. |

Frequently Asked Questions About Q4 2024 High-Growth Areas

Primary high-growth sectors for Q4 2024 include artificial intelligence, biotechnology, and renewable energy. These areas are seeing significant investment due to technological advancements, increasing demand, and supportive regulatory environments globally, as per recent market analyses.

Southeast Asia, particularly Vietnam and Indonesia, along with specific North American cities like Austin and Miami, are identified as top geographic hotspots. These regions boast favorable economic conditions, strong infrastructure, and burgeoning consumer bases.

Risk mitigation strategies include thorough diversification across asset classes, sectors, and geographies. Maintaining a long-term investment horizon and leveraging expert analysis alongside advanced data analytics can also help navigate market volatility effectively.

Government policies and regulations significantly influence investment attractiveness. Tax incentives, trade agreements, and environmental mandates can either accelerate or hinder growth in specific sectors and regions, necessitating continuous monitoring by investors.

Q4 2024 data is time-sensitive because market conditions and opportunities can evolve rapidly. Early identification of high-growth areas allows investors to position themselves strategically, capturing initial gains before broader market awareness impacts valuations and entry points.

What This Means for Your Portfolio

The insights from Q4 2024 data underscore a critical juncture for investors. The identified high-growth areas are not merely statistical anomalies but represent fundamental shifts in global economic power and technological advancement. Ignoring these trends could mean missing out on substantial returns. This information provides a roadmap for re-evaluating existing portfolios and strategically allocating capital into sectors and geographies poised for exponential expansion. The market is moving, and those who adapt swiftly will be best positioned for future success.