First-Time Homebuyer Programs 2025: Accessing Down Payment Assistance Up to $10,000

First-time homebuyer programs in 2025 are poised to offer significant down payment assistance, with many initiatives providing up to $10,000 to eligible individuals and families seeking homeownership.

Aspiring homeowners are eagerly anticipating the opportunities that First-Time Homebuyer Programs 2025: Accessing Down Payment Assistance Up To $10,000 will present, particularly as new initiatives aim to make homeownership more attainable. This year, attention is sharply focused on programs designed to alleviate the financial burden of a down payment, a critical hurdle for many.

Understanding the Landscape of 2025 Homebuyer Programs

As of late 2024, the housing market continues to evolve, prompting both federal and state governments to refine and introduce new support mechanisms for first-time homebuyers. The year 2025 is expected to bring a renewed emphasis on accessibility, with various programs offering direct financial aid for down payments, often reaching up to $10,000 or more, alongside other incentives. These initiatives are designed to address the persistent challenge of accumulating sufficient funds for a down payment in an increasingly competitive market.

Reports from housing agencies indicate a strategic shift towards broader eligibility criteria and streamlined application processes. This push for efficiency aims to ensure that financial assistance reaches those who need it most, helping to close the gap between renting and owning. The overarching goal is to foster greater housing stability and economic growth by empowering a new generation of homeowners.

Key Program Categories Emerging for 2025

- Down Payment Assistance (DPA) Programs: These are often grants or forgivable loans that do not require repayment if certain conditions are met, such as living in the home for a specified period.

- Closing Cost Assistance: Similar to DPA, these programs help cover the additional fees associated with purchasing a home, which can often amount to several thousands of dollars.

- First Mortgage Programs: Many states and local entities offer specialized mortgage products with competitive interest rates and flexible underwriting guidelines tailored for first-time buyers.

- Tax Credits: Mortgage Credit Certificates (MCCs) allow homebuyers to claim a portion of their mortgage interest as a tax credit, providing ongoing savings.

These categories represent the primary avenues through which first-time homebuyers can expect to receive support in 2025. It is crucial for prospective buyers to research offerings specific to their state and local jurisdictions, as eligibility requirements and available funds can vary significantly.

Eligibility Requirements for Down Payment Assistance in 2025

Navigating the eligibility criteria for First-Time Homebuyer Programs 2025: Accessing Down Payment Assistance Up To $10,000 is a critical first step for any prospective buyer. While specific requirements can vary by program and location, several common factors typically determine eligibility. These often include income limits, credit score minimums, and the definition of a ‘first-time homebuyer’ itself.

Generally, a first-time homebuyer is defined as someone who has not owned a primary residence in the past three years. This definition can sometimes include individuals who previously owned a home but lost it due to divorce, job relocation, or other specific circumstances. Additionally, many programs target low-to-moderate income households, with income limits often tied to the area median income (AMI).

Common Eligibility Criteria

- Income Limits: Most programs set income caps, often expressed as a percentage of the Area Median Income (AMI). These limits ensure assistance goes to those who genuinely need it.

- Credit Score: While some programs are more flexible, a minimum credit score, typically in the mid-600s, is often required to demonstrate financial responsibility.

- Homebuyer Education: Many programs mandate participation in a homebuyer education course, designed to prepare individuals for the responsibilities of homeownership.

- Property Type and Location: Some assistance programs are restricted to specific property types (e.g., single-family homes) or within designated geographical areas.

Potential applicants should begin by checking the websites of their state housing finance agency (HFA) or local government housing departments. These resources provide the most current and accurate information regarding specific program requirements and application deadlines for 2025. Understanding these criteria upfront can save significant time and effort in the homebuying process.

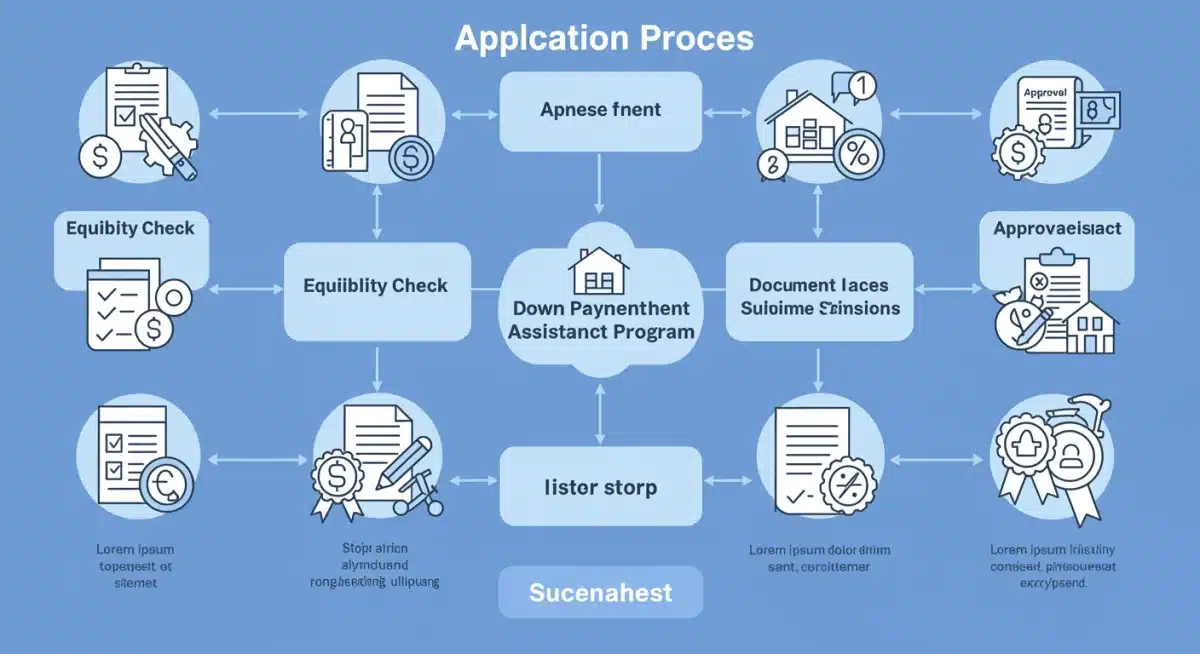

Application Process: Securing Your 2025 Down Payment Grant

The application process for First-Time Homebuyer Programs 2025: Accessing Down Payment Assistance Up To $10,000 requires careful attention to detail and timely submission of documentation. While each program may have unique steps, a general framework outlines what prospective buyers can expect. The journey typically begins with understanding the available programs and then diligently preparing the necessary paperwork.

It is advisable to start gathering financial documents early, including tax returns, pay stubs, bank statements, and credit reports. Lenders and housing counselors often play a pivotal role in guiding applicants through this process, helping to identify suitable programs and ensure all requirements are met. The goal is to present a complete and compelling application that demonstrates both need and readiness for homeownership.

Steps to a Successful Application

- Research Available Programs: Identify state, local, and federal programs that align with your financial situation and homebuying goals.

- Attend Homebuyer Education: Complete any mandatory homebuyer education courses, which provide valuable insights into the homebuying process.

- Get Pre-Approved for a Mortgage: Obtain pre-approval from a lender, as this helps determine your budget and often validates your eligibility for assistance.

- Gather Documentation: Compile all required financial and personal documents, ensuring they are current and accurate.

- Submit Application: Work with your lender or housing counselor to submit the complete application package to the relevant program administrator.

Timelines for approval can vary, ranging from a few weeks to several months, depending on the program’s administrative capacity and the volume of applications. Patience and proactive follow-up are key during this phase. Successful applicants will then receive confirmation of their down payment assistance, which can be directly applied at closing.

Federal vs. State and Local Programs in 2025

Understanding the distinction between federal, state, and local First-Time Homebuyer Programs 2025: Accessing Down Payment Assistance Up To $10,000 is crucial for prospective homeowners. While federal initiatives often provide broad guidelines and funding, state and local programs tend to offer more targeted assistance, often with specific regional needs in mind. This layered approach ensures a wide array of support is available across different communities.

Federal programs, such as those backed by the FHA, VA, and USDA, typically offer mortgage insurance or guarantees, making it easier for lenders to approve loans with lower down payments or more flexible terms. These programs are widely accessible but may not always include direct down payment assistance. Conversely, state and local programs frequently provide direct grants or forgivable loans for down payments and closing costs, often supplementing federal loan products.

For instance, state housing finance agencies (HFAs) are instrumental in administering many of these localized programs. They receive federal funding but tailor programs to meet the unique economic and demographic conditions of their state. This means a program in California might have different income limits or property requirements than a similar program in Texas.

Navigating Program Options

Prospective buyers should start by exploring offerings from their state’s HFA, as these agencies often serve as a central hub for information on both state-specific and federal programs available within their jurisdiction. Local city or county housing departments also frequently offer their own assistance programs, sometimes in partnership with non-profit organizations, which can provide additional layers of support.

The key is to conduct thorough research, comparing the eligibility criteria and benefits of various programs. Some buyers may even qualify for a combination of federal, state, and local assistance, maximizing their financial aid. Consulting with a housing counselor or a lender experienced in these programs can significantly simplify this complex landscape, helping buyers identify the best possible options for their individual circumstances.

Maximizing Your Down Payment Assistance: Strategies for 2025

To fully leverage the opportunities presented by First-Time Homebuyer Programs 2025: Accessing Down Payment Assistance Up To $10,000, strategic planning is essential. Simply qualifying for assistance is one step; maximizing its impact requires understanding how to combine programs, improve financial standing, and make informed choices throughout the homebuying journey. Every dollar of assistance can significantly reduce the initial financial burden of purchasing a home.

One effective strategy is to explore options for stacking assistance. Some programs allow buyers to combine down payment grants with closing cost assistance or even specialized first mortgage products. This can lead to substantial savings, potentially covering a significant portion of upfront costs. However, it is crucial to verify with program administrators and lenders whether such combinations are permissible, as rules can vary.

Improving your financial profile is another key strategy. A stronger credit score can unlock better interest rates on your mortgage, reducing long-term costs. Reducing existing debt and saving additional funds, even beyond the assistance amount, can also strengthen your application and provide a larger buffer for unforeseen expenses during and after the home purchase.

Tips for Optimal Benefit

- Combine Programs Wisely: Research if your state or local DPA programs can be used in conjunction with federal loans (FHA, VA, USDA).

- Boost Your Credit Score: Work on improving your credit score months in advance to qualify for more favorable loan terms.

- Save Additional Funds: Aim to save more than the minimum required, as this provides financial flexibility and demonstrates readiness for homeownership.

- Seek Expert Advice: Engage with housing counselors and lenders who specialize in first-time homebuyer programs to navigate complex options.

Furthermore, being flexible with your property search can also enhance the value of your assistance. Some programs might offer higher assistance amounts for homes in specific revitalization areas or for properties that meet certain energy efficiency standards. Staying informed about these nuances can lead to greater financial benefits and a more sustainable homeownership experience.

The Future of Homeownership: Impact of 2025 Programs

The introduction and expansion of First-Time Homebuyer Programs 2025: Accessing Down Payment Assistance Up To $10,000 are poised to have a significant impact on the landscape of homeownership. These initiatives are not merely about financial aid; they represent a concerted effort to foster economic stability, reduce wealth inequality, and revitalize communities by increasing access to homeownership for eligible individuals and families.

By directly addressing one of the largest barriers to entry—the down payment—these programs empower a new cohort of buyers who might otherwise be priced out of the market. This influx of new homeowners can stimulate local economies through property purchases, home improvements, and increased consumer spending. Moreover, diverse homeownership contributes to more stable and vibrant communities.

Looking ahead, the success of 2025 programs will likely influence future housing policy. If these initiatives prove effective in boosting homeownership rates and supporting equitable access, lawmakers may be encouraged to sustain or even expand such programs in subsequent years. This could lead to a more permanent framework of support for first-time buyers, adapting to market conditions and evolving financial needs.

Long-Term Benefits of Assistance

- Increased Homeownership Rates: More individuals and families will be able to transition from renting to owning, building equity and personal wealth.

- Community Revitalization: Homeownership often leads to greater civic engagement and investment in local communities, fostering stability and growth.

- Reduced Housing Inequality: By targeting low-to-moderate income households, programs help bridge the gap in housing access and wealth accumulation.

- Economic Stimulus: Home purchases and related activities, such as renovations and furnishing, boost local economies.

The ongoing dialogue between federal, state, and local entities will be crucial in refining these programs to ensure they remain relevant and impactful. As the housing market continues to present challenges, the adaptability and sustained funding of first-time homebuyer initiatives will be paramount in shaping a more inclusive future for homeownership.

| Key Point | Brief Description |

|---|---|

| Down Payment Assistance | Programs in 2025 offer up to $10,000 or more to cover initial home purchase costs for eligible first-time buyers. |

| Eligibility Criteria | Common requirements include income limits, credit score minimums, and completing homebuyer education courses. |

| Application Process | Involves researching programs, pre-approval, gathering documents, and submitting through lenders or housing agencies. |

| Program Types | Mix of federal, state, and local initiatives offering grants, forgivable loans, and specialized mortgage products. |

Frequently Asked Questions About 2025 Homebuyer Programs

Generally, a first-time homebuyer is an individual who has not owned a primary residence in the past three years. Some programs make exceptions for those who lost a home due to divorce, job relocation, or other specific circumstances, allowing them to qualify.

Many programs in 2025 are offering significant down payment assistance, with amounts frequently reaching up to $10,000. Some initiatives, especially those combining state and local funds, may offer even more, depending on your eligibility and location.

Yes, most down payment assistance programs in 2025 have income limits. These are typically set as a percentage of the Area Median Income (AMI) and vary by program and geographical location. It’s essential to check specific program guidelines.

While specific requirements vary, most programs do require a minimum credit score, often in the mid-600s, to demonstrate financial responsibility. A higher score can also help secure better interest rates on your mortgage loan.

It is often possible to combine federal, state, and local assistance programs, but this depends on the specific rules of each program. You should consult with a housing counselor or an experienced lender to determine permissible combinations.

Looking Ahead: The Future Trajectory of Homebuyer Support

The evolving landscape of First-Time Homebuyer Programs 2025: Accessing Down Payment Assistance Up To $10,000 signals a sustained commitment to making homeownership a reality for more Americans. As housing affordability remains a national concern, the responsiveness and adaptability of these programs will be under continuous scrutiny. Expect ongoing adjustments to eligibility, funding, and program structures as economic conditions shift and new data emerges on program effectiveness. Policymakers are likely to prioritize initiatives that demonstrate tangible results in narrowing the homeownership gap and fostering long-term financial stability for first-time buyers. Staying informed through official housing agencies and trusted financial advisors will be paramount for anyone planning to enter the housing market in the coming years.