E-commerce Infrastructure Investment: A 5-Year US Growth Forecast

Investing in e-commerce infrastructure presents a compelling opportunity for US investors, driven by projected sustained digital retail growth, technological advancements in logistics and payment systems, and evolving consumer behaviors over the next five years.

The landscape of modern commerce is undeniably digital. For discerning US investors, the question isn’t whether e-commerce will continue to grow, but rather where the most strategic opportunities lie within its foundational elements. This article delves into Investing in E-commerce Infrastructure: A 5-Year Growth Forecast for US Investors, analyzing the critical components shaping this dynamic sector and identifying key areas ripe for capital injection between now and 2029.

Understanding the E-commerce Infrastructure Ecosystem

The backbone of the thriving e-commerce industry is a complex and interconnected infrastructure. This ecosystem extends beyond mere websites and online storefronts, encompassing everything required to get a product from manufacturer to consumer efficiently and reliably. For investors, grasping these foundational layers is key to identifying high-growth potential.

Understanding the components of this infrastructure allows for a more nuanced investment strategy. Rather than generalized exposure to e-commerce, a focus on specific infrastructure segments can yield superior returns, especially those addressing bottlenecks or new demands in the supply chain and digital experience. The technological advancements driving efficiency and customer satisfaction are particularly noteworthy and present significant opportunities.

Key Pillars of E-commerce Infrastructure

Several critical areas form the pillars of a robust e-commerce operation, each presenting unique investment prospects. These pillars are constantly evolving, adapting to technological progress and shifting consumer expectations.

- Logistics and Fulfillment: This includes warehouses, robotics for sorting and picking, last-mile delivery solutions, and cold chain logistics for perishables.

- Payment Processing and Fintech: Secure, diversified payment gateways, including mobile payments, cryptocurrency integration, and fraud prevention technologies.

- Data Centers and Cloud Computing: The underlying digital real estate that powers websites, processes transactions, and stores vast amounts of customer data.

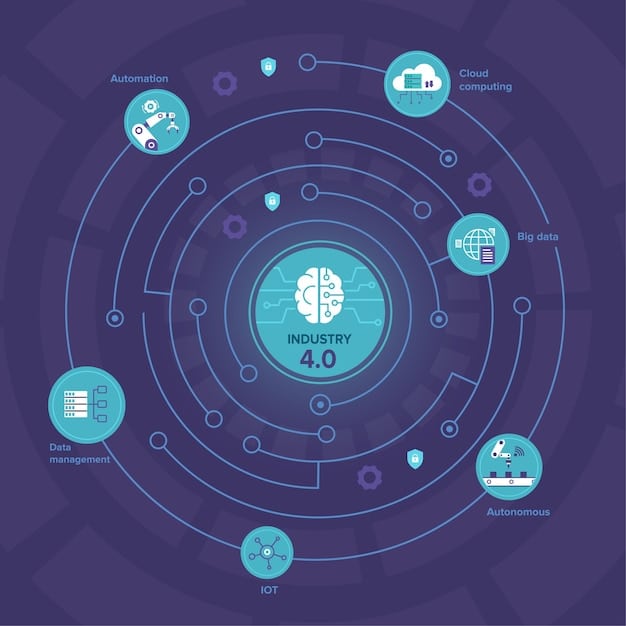

The Role of Technology and Automation

Technology is not merely a facilitator but a primary driver of innovation within e-commerce infrastructure. Automation, artificial intelligence, and machine learning are revolutionizing efficiency and scalability. For investors, companies at the forefront of these technological shifts represent high-potential targets.

The adoption of robots in fulfillment centers drastically reduces processing times and labor costs, while AI optimizes inventory management and predicts consumer demand. These advancements are not just incremental improvements, but fundamental shifts in how e-commerce operations are run, driving significant value creation.

Market Drivers and Growth Forecasts (2025-2029)

Over the next five years, several powerful macroeconomic and behavioral trends are poised to fuel substantial growth in e-commerce infrastructure investment. These drivers are not transient but represent fundamental shifts in how consumers shop and businesses operate. US investors should pay close attention to these long-term enablers.

The enduring shift towards online shopping, accelerated by recent global events, is a primary catalyst. This sustained transition creates a perpetual demand for more sophisticated and resilient infrastructure to support the increasing volume and complexity of digital transactions. Furthermore, technological innovations are rapidly expanding the capabilities of this infrastructure.

Consumer Behavior and Digital Adoption

The continued evolution of consumer habits, particularly among younger demographics, points to an irreversible trend towards digital-first purchasing. This includes a growing expectation for faster delivery, personalized experiences, and seamless returns, all of which necessitate robust infrastructure.

Mobile commerce, social commerce, and the rise of subscription models further embed e-commerce into daily life. Investors eyeing this shift should consider companies that are enabling these new purchasing paradigms, providing the digital roads and bridges for this consumer evolution.

Technological Advancements in Logistics and AI

Technological breakthroughs in logistics, such as drone delivery trials and autonomous vehicles, while not yet mainstream, signal the future direction. More immediately impactful are advancements in warehouse automation, powered by AI and robotics, which promise unprecedented efficiency gains.

These technologies are transforming the physical handling of goods, making supply chains more agile and cost-effective. Investment in companies developing or deploying these technologies offers exposure to the very engines of future e-commerce growth and operational excellence.

The market for e-commerce infrastructure in the US is projected to expand significantly, driven by these factors. Analysts predict a compounding annual growth rate, with key segments like logistics technology and cloud services seeing particularly strong upticks. Identifying the companies well-positioned to capitalize on these trends will be crucial for investor success.

Key Investment Areas and Opportunities

Identifying the most promising investment areas within e-commerce infrastructure requires a detailed understanding of both current market needs and future growth trajectories. For US investors, strategic allocation across diverse segments can mitigate risk while maximizing potential returns. This section explores specific facets with high-growth potential, emphasizing the blend of foundational services and cutting-edge innovation.

The evolving demands of the digital consumer are directly shaping these opportunities. Faster delivery, enhanced personalization, and seamless online-to-offline experiences all depend on underlying infrastructure improvements. Savvy investors will seek out companies that are not just meeting these demands but are anticipating future ones.

Warehousing and Fulfillment Automation

With the relentless pressure for expedited shipping, the automation of warehouses and fulfillment centers is no longer a luxury but a necessity. Companies specializing in robotics, automated storage and retrieval systems (AS/RS), and sophisticated warehouse management software (WMS) are poised for substantial growth. These innovations directly address labor shortages and efficiency demands.

- Robotics for Sorting and Picking: Reduces human intervention and speeds up processing times.

- Automated Guided Vehicles (AGVs): Efficiently transport goods within vast warehouse spaces.

- Advanced WMS Integration: Optimizes inventory, streamlines operations, and provides real-time data.

Last-Mile Delivery Solutions

The “last mile” – the final leg of delivery to the customer’s doorstep – remains one of the most expensive and complex aspects of e-commerce. Investments in innovative last-mile solutions, including electric vehicle fleets, hyperlocal distribution hubs, and drone delivery technologies, are critical for efficiency and sustainability. Companies that can solve this puzzle stand to gain significant market share.

The demand for rapid and flexible delivery options continues to push companies to innovate in this space. For investors, this means looking at firms developing environmentally friendly transport options, as well as those leveraging data to optimize delivery routes and times.

Cybersecurity and Data Privacy

As e-commerce transactions increase, so does the volume of sensitive data exchanged. Robust cybersecurity infrastructure and data privacy solutions are paramount to maintaining consumer trust and complying with evolving regulations. Investing in companies that provide advanced encryption, fraud detection, and privacy-enhancing technologies is a defensive yet highly growth-oriented play.

Breaches can be devastating for e-commerce businesses, making strong security a non-negotiable part of their operational backbone. Funds allocated to cybersecurity not only protect assets but also cement customer loyalty, an invaluable commodity in the digital age. This area provides essential safeguards for the entire ecosystem.

Challenges and Risks for Investors

While the opportunities in e-commerce infrastructure are substantial, US investors must navigate a landscape fraught with unique challenges and inherent risks. A balanced perspective requires acknowledging these potential pitfalls, as they can significantly impact investment returns and long-term viability. Understanding and mitigating these risks is as crucial as identifying growth sectors.

The rapid pace of technological change and evolving regulatory environments present ongoing hurdles. Furthermore, market saturation in certain areas and intense competition can compress margins and slow growth for some players. Diligent due diligence is paramount for investors in this dynamic sector.

Regulatory and Compliance Hurdles

The e-commerce landscape is increasingly shaped by complex and often divergent regulations concerning data privacy (e.g., CCPA, GDPR-like state laws), consumer protection, and antitrust scrutiny. Companies that fail to adapt their infrastructure to these evolving legal frameworks face significant fines and reputational damage.

For investors, this means favoring companies with robust legal teams and proactive compliance strategies. The cost of non-compliance can be astronomical, making regulatory adherence a critical factor in investment viability. These legal challenges add layers of complexity to operational management.

Intense Competition and Market Saturation

The perceived high growth in e-commerce infrastructure has attracted numerous players, leading to intense competition in certain segments, particularly in mature markets like the US. This saturation can drive down prices, compress profit margins, and make it difficult for new entrants or less differentiated companies to gain traction.

Investors should seek out companies with clear competitive advantages, strong intellectual property, or innovative business models. Differentiated services, superior technology, or a unique niche can provide a buffer against generalized market pressures. The ability to innovate continuously is a powerful defense.

Technological Obsolescence and Rapid Innovation

The very innovation that drives growth in e-commerce infrastructure also presents a risk: rapid technological obsolescence. What is cutting-edge today could be outdated tomorrow. Investments in technologies that quickly become superseded can lead to significant losses.

Therefore, investors need to back companies that demonstrate agility, a strong research and development pipeline, and the ability to pivot and adapt to new standards and emerging technologies. Continuous investment in innovation is a hallmark of resilient infrastructure providers in this sector.

The Impact of Emerging Technologies

The next five years will be defined by the increasing integration of emerging technologies into the core fabric of e-commerce infrastructure. These innovations are not peripheral enhancements; they are transformative forces that will reshape how goods are bought, sold, and delivered. For US investors, understanding these shifts is key to positioning portfolios for future growth.

From blockchain revolutionizing supply chain transparency to the metaverse offering new retail experiences, the technological frontier is rapidly expanding. Early identification of companies leveraging these technologies effectively can provide a significant competitive edge and substantial long-term returns. Staying abreast of these developments is not merely advantageous, but necessary.

Blockchain for Supply Chain Transparency

Blockchain technology offers the potential to create immutable, transparent records of every step in a product’s journey, from manufacturing to delivery. This increased transparency can address issues of authenticity, ethical sourcing, and operational efficiency, reducing fraud and improving consumer trust.

Investment opportunities exist in companies developing blockchain-based supply chain management platforms or integrating these solutions into existing logistics networks. The demand for verifiable product histories is growing, making blockchain a powerful tool for enhancing trust in the e-commerce ecosystem.

AI and Machine Learning in Personalization and Optimization

Artificial intelligence and machine learning are becoming indispensable for hyper-personalization, fraud detection, and operational optimization. From predictive analytics that anticipate demand to AI-powered chatbots that enhance customer service, these technologies are refining every aspect of the e-commerce experience.

- Predictive Analytics: Forecasts consumer behavior and inventory needs with greater accuracy.

- Personalized Marketing: AI tailors product recommendations and promotions, increasing conversion rates.

- Fraud Detection: Machine learning algorithms identify and prevent fraudulent transactions in real-time.

Edge Computing for Faster Processing

Edge computing brings data processing closer to the source of data generation, dramatically reducing latency. For e-commerce, this means faster loading times for websites, quicker processing of in-store pickups, and more responsive logistics systems, all contributing to a superior customer experience.

Investments in edge computing infrastructure, particularly in hardware and software solutions that support localized processing, represent a forward-looking strategy. As IoT devices proliferate in retail and logistics, edge computing will become increasingly vital for real-time operations, ensuring seamless data flow and immediate action.

Strategic Investment Approaches for US Investors

Navigating the complexities of investing in e-commerce infrastructure requires a strategic approach tailored to the sector’s dynamic nature. US investors have a range of options, from direct equity investments to venture capital and thematic ETFs, each offering varying levels of risk and potential return. The key lies in diversification and a thorough understanding of underlying business models.

A thoughtful strategy will consider the long-term trends identified, while also accounting for the specific challenges and risks. This includes assessing a company’s innovation pipeline, its market position, and its ability to adapt to regulatory changes and technological shifts.

Diversification Across Sub-Sectors

Rather than concentrating investments in a single sub-sector, a diversified approach across logistics, payment processing, cybersecurity, and cloud services can mitigate risk. This strategy ensures exposure to various facets of e-commerce infrastructure, balancing high-growth potential with foundational stability.

For instance, an investor might consider a blend of established logistics providers with promising fintech startups. This creates a portfolio that benefits from diverse drivers of growth, reducing reliance on any one segment’s performance and increasing overall resilience in a volatile market.

Focus on Innovation and Scalability

Prioritize companies that demonstrate a strong commitment to innovation and possess scalable business models. These are the firms most likely to adapt to future market demands and technological advancements, generating sustainable long-term growth. Investigate their R&D spending and patent portfolios.

Scalability is crucial: businesses with operations that can easily expand to accommodate increased demand without proportionally increasing costs are highly attractive. This includes software-as-a-service (SaaS) providers in logistics or cloud infrastructure firms that can expand their service offerings almost infinitely.

Considering ESG Factors in Investment Decisions

Environmental, Social, and Governance (ESG) factors are increasingly important in investment decisions. In e-commerce infrastructure, this translates to supporting companies committed to sustainable logistics (e.g., electric fleets, efficient warehousing), fair labor practices, and robust data governance.

Investing in ESG-compliant companies not only aligns with ethical principles but also often correlates with better long-term financial performance. Consumers and regulators are increasingly demanding sustainability, making ESG a material consideration for the future viability of e-commerce infrastructure providers.

The Future Landscape: 2029 and Beyond

Looking towards 2029 and beyond, the e-commerce infrastructure landscape is poised for even greater transformation, driven by emerging technologies and evolving global dynamics. For US investors, anticipating these shifts is critical for identifying the next wave of investment opportunities and staying ahead of market trends. The foundations laid in the next five years will dictate the shape of e-commerce for decades to come.

The integration of immersive technologies, the continued push for sustainability, and the global nature of digital commerce will fundamentally alter strategies. Companies that can seamlessly adapt to these changes, offering innovative solutions, will be the true market leaders.

Immersive Retail and the Metaverse

The advent of the metaverse and augmented reality (AR) promises to create new dimensions of e-commerce. While still nascent, investments in infrastructure supporting immersive retail experiences – from high-performance computing to virtual reality development platforms – could yield significant long-term returns.

This future vision involves digital storefronts that consumers can virtually “walk through,” trying on clothes or visualizing furniture in their homes before purchase. The infrastructure required to power such hyper-realistic and interactive experiences will be immense and represents a frontier for innovative investment.

Sustainability as a Core Infrastructure Pillar

Sustainability is transitioning from a desirable add-on to a core pillar of e-commerce infrastructure. Investors will increasingly favor solutions that reduce carbon footprints, minimize waste, and promote eco-friendly practices across the supply chain, from green warehouses to carbon-neutral last-mile delivery.

Companies that embed sustainability into their operational design, rather than treating it as an afterthought, will attract greater capital and consumer loyalty. This focus on environmental responsibility will drive innovation in renewable energy for data centers and logistics, presenting a new category of opportunities.

Global Expansion and Cross-Border E-commerce

While this forecast focuses on US investors, the global nature of e-commerce means that infrastructure investments often have cross-border implications. Facilitating seamless international trade, including efficient customs processing, multi-currency payment solutions, and global logistics networks, will become increasingly vital.

For US investors, exploring companies that specialize in cross-border e-commerce infrastructure can offer exposure to burgeoning markets and diversify geographical risk. The ability to connect global consumers with global products efficiently will be a defining characteristic of successful infrastructure providers.

| Key Aspect | Brief Description |

|---|---|

| 🛒 Market Growth | Sustained e-commerce expansion driving demand for robust foundational systems. |

| 📦 Logistics & AI | Automation, robotics, and AI optimizing warehouse and delivery efficiency. |

| 🔒 Cybersecurity | Critical investments in data protection and fraud prevention for consumer trust. |

| 💡 Emerging Tech | Blockchain, AI, and edge computing reshaping future operational capabilities. |

Frequently Asked Questions About E-commerce Infrastructure Investment

The primary drivers include the continuous shift in consumer behavior towards online shopping, rapid technological advancements in logistics and AI, and the increasing demand for faster and more personalized delivery services. These factors collectively create a robust and expanding market for infrastructural investment.

High-potential areas include warehouse and fulfillment automation (robotics, WMS), innovative last-mile delivery solutions (EV fleets, drones), advanced cybersecurity and data privacy technologies, and cloud computing services. These segments are crucial for scalability, efficiency, and maintaining consumer trust.

Key risks involve navigating complex and evolving regulatory landscapes (data privacy, antitrust), intense competition leading to market saturation, and the rapid pace of technological obsolescence. Investors should prioritize companies with strong compliance frameworks and continuous innovation strategies.

AI will drive hyper-personalization, demand forecasting, and fraud detection, while blockchain offers enhanced supply chain transparency and accountability. These technologies are poised to revolutionize operational efficiency, security, and customer experience, creating new investment opportunities.

A diversified approach across sub-sectors is recommended, focusing on companies demonstrating robust innovation, scalability, and adherence to ESG principles. Identifying firms with sustainable competitive advantages and adaptability to future trends will be crucial for long-term success.

Conclusion – Investing in the Backbone of Digital Commerce

The dynamic realm of e-commerce infrastructure continues to represent one of the most resilient and high-potential frontiers for U.S. investors over the next five years. The ongoing surge in digital commerce, supported by consumer behavior shifts and global logistics transformation, highlights the growing importance of the systems that power online retail ecosystems. From fulfillment automation to integrated payment frameworks, the structural components driving this digital economy are rapidly maturing into an investment class of their own.

This evolution is not happening in isolation. Businesses are rethinking their infrastructure strategies to balance scalability with sustainability, prioritizing technologies that improve customer experience while optimizing backend efficiency. Insights from resources like the E-commerce Infrastructure overview by DCKAP emphasize how well-designed infrastructure forms the foundation for long-term competitive advantage—enabling agility, security, and interoperability across platforms and markets.

Looking ahead, investors who focus on automation, last-mile delivery innovation, data-driven personalization, and cybersecurity resilience will be best positioned to capitalize on the sector’s sustained expansion. As artificial intelligence and cloud-native solutions reshape supply chain visibility and consumer intelligence, the distinction between commerce and technology investment will continue to blur. The challenge, and the opportunity, lie in strategically diversifying portfolios to include both core infrastructure providers and disruptive startups defining the next wave of digital commerce evolution.

Ultimately, the future of e-commerce belongs to those who understand that infrastructure is not merely the foundation—it is the engine of innovation. A balanced, forward-looking approach that weighs scalability against risk, and efficiency against adaptability, will unlock the most robust and sustainable returns in this ever-expanding digital frontier.