Reduce Overhead: Cloud Accounting Saves Small Businesses 15% Annually

Reduce overhead by 15% annually for your small business by switching to cloud-based accounting, streamlining financial processes, automating tasks, and providing real-time insights, ultimately saving time and money.

Is your small business looking for ways to reduce overhead? One highly effective strategy gaining traction is switching to cloud-based accounting. This transition can potentially save your business up to 15% annually by streamlining operations, improving accuracy, and providing real-time insights.

Understanding Overhead Costs and Their Impact

Overhead costs are the expenses your business incurs to keep running, regardless of sales volume. These can include rent, utilities, insurance, and administrative salaries. Understanding how these costs impact your bottom line is crucial for effective financial management.

Let’s dive deeper into what overhead costs are and why managing them effectively is essential for the health of your small business.

Types of Overhead Costs

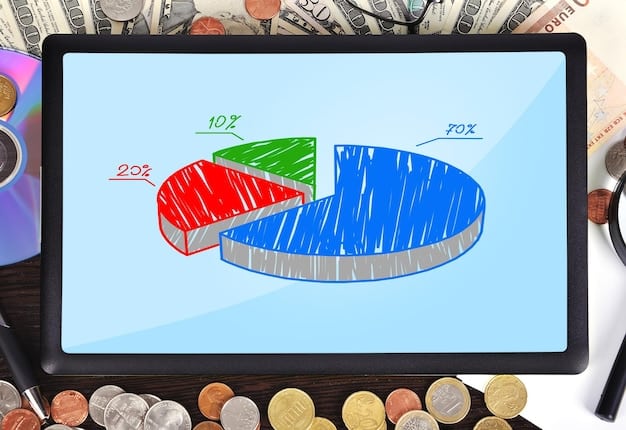

Overhead costs can be categorized into fixed, variable, and semi-variable costs. Fixed costs remain constant, variable costs fluctuate with production, and semi-variable costs have both fixed and variable components.

- Fixed Costs: These include rent, insurance, and salaries of administrative staff.

- Variable Costs: These are costs like utilities, shipping, and advertising, which vary based on sales.

- Semi-Variable Costs: Costs like phone bills, which have a monthly fee plus usage charges.

Identifying and categorizing these costs is the first step toward managing them effectively.

The Impact of High Overhead Costs

High overhead costs eat into your profit margins, reduce your competitiveness, and can stifle growth. Reducing these costs can dramatically improve your profitability and financial stability.

By understanding and managing overhead costs, your business can achieve better financial health and long-term sustainability.

The Benefits of Cloud-Based Accounting

Cloud-based accounting software offers numerous advantages over traditional accounting methods. It provides real-time access to financial data, automates routine tasks, and enhances collaboration among team members. These benefits translate to significant cost savings and improved efficiency.

Let’s explore in detail how cloud-based accounting can transform your small business finances.

Accessibility and Collaboration

Cloud-based accounting allows you to access your financial data from anywhere with an internet connection. This enhances collaboration with your team and your accountant, leading to better decision-making.

- Real-Time Access: Access your financial data anytime, anywhere.

- Improved Collaboration: Share data with team members and accountants easily.

- Better Decision-Making: Make informed decisions based on up-to-date financial information.

The accessibility and collaboration features of cloud-based accounting create a more agile and responsive business environment.

Automation and Efficiency

Cloud accounting automates many routine tasks, such as bank reconciliation, invoice generation, and expense tracking. This saves time and reduces the risk of errors.

Automating these tasks not only saves time but also frees up your team to focus on more strategic activities.

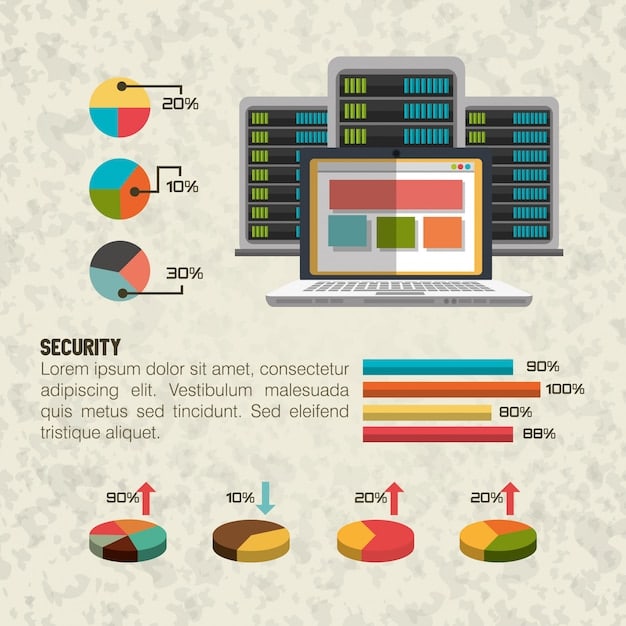

Enhanced Security

Cloud accounting providers invest heavily in security measures to protect your financial data. This includes encryption, multi-factor authentication, and regular backups.

With enhanced security measures, you can rest assured knowing your financial data is safe and protected.

How Cloud Accounting Reduces Overhead Costs

Switching to cloud-based accounting can directly reduce several overhead costs. By automating tasks, reducing paper usage, and eliminating the need for expensive hardware and software, businesses can achieve significant savings.

Let’s break down the specific areas where cloud accounting can lead to cost reductions.

Reducing IT Costs

With cloud accounting, you no longer need to invest in expensive servers, software licenses, and IT support. The provider handles all the infrastructure and maintenance.

This can result in considerable savings, especially for small businesses with limited IT budgets.

Lowering Labor Costs

Automation reduces the time spent on manual tasks, freeing up employees to focus on more valuable activities. This can lead to lower labor costs and increased productivity.

- Automated Data Entry: Reduce manual data entry and human errors.

- Faster Reporting: Generate financial reports quickly and easily.

- Improved Accuracy: Minimize errors in financial records.

The efficiency gains from automation can significantly impact your labor costs.

Minimizing Paper and Storage Costs

Cloud accounting reduces the need for paper documents and physical storage space. This saves money on paper, ink, filing cabinets, and storage facilities.

Going paperless is not only cost-effective but also environmentally friendly.

Implementing Cloud-Based Accounting: A Step-by-Step Guide

Implementing cloud-based accounting requires careful planning and execution. Choosing the right software, migrating your data, and training your staff are crucial steps in the process.

Here’s a step-by-step guide to help you navigate the transition smoothly.

Choosing the Right Software

Selecting the right cloud accounting software depends on your business needs and budget. Consider factors like features, scalability, and integration with other business systems.

Popular options include QuickBooks Online, Xero, and Sage Business Cloud Accounting.

Data Migration and Setup

Migrating your financial data to the cloud requires careful planning to ensure accuracy and avoid data loss. Work with your accountant or a cloud accounting specialist to ensure a smooth transition.

- Backup Your Data: Always create a backup of your existing financial data.

- Clean Up Data: Remove old or inaccurate data before migrating.

- Test the Migration: Verify that all data has been transferred correctly.

Proper data migration is essential for maintaining the integrity of your financial records.

Training and Support

Provide adequate training and support to your staff to ensure they can effectively use the new software. Many cloud accounting providers offer training resources and support services.

Investing in training can help your team adapt quickly and realize the full benefits of cloud accounting.

Measuring the ROI of Cloud Accounting

To determine the true cost savings of cloud accounting, it’s essential to measure the return on investment (ROI). Track key metrics to assess the impact of the switch on your overhead costs and overall profitability.

Let’s examine the key metrics to monitor and how to calculate the ROI.

Key Metrics to Track

Monitor metrics such as IT costs, labor costs, paper and storage costs, and accountant fees. Compare these metrics before and after implementing cloud accounting to measure the savings.

Tracking these metrics will provide a clear picture of the financial impact of cloud accounting.

Calculating the ROI

Calculate the ROI by dividing the cost savings by the initial investment and multiplying by 100. This will give you the percentage return on your investment.

- Calculate Total Savings: Determine the total savings from reduced overhead costs.

- Calculate Initial Investment: Add up the costs of software, data migration, and training.

- Calculate ROI: (Total Savings / Initial Investment) x 100.

A positive ROI indicates that cloud accounting is a worthwhile investment for your business.

Case Studies and Examples

Real-world examples can provide further insights into the potential cost savings of cloud accounting. Look for case studies of businesses similar to yours that have successfully made the switch.

These examples can help you visualize the potential benefits for your own business.

Overcoming Common Challenges in Cloud Accounting Adoption

While the benefits of cloud accounting are clear, businesses may face challenges during adoption. Addressing these challenges proactively can help ensure a smooth and successful transition.

Let’s discuss some common challenges and how to overcome them.

Data Security Concerns

Some businesses may worry about the security of their financial data in the cloud. Choose a reputable provider with robust security measures and ensure they comply with industry standards.

Addressing security concerns can build trust and facilitate the adoption process.

Integration Issues

Integrating cloud accounting software with other business systems can be complex. Choose software that offers seamless integration with your existing tools or work with a specialist to set up the integration.

- Choose Compatible Software: Select software that integrates with your existing systems.

- Plan the Integration: Develop a detailed plan for integrating the software.

- Test the Integration: Verify that the integration works correctly before going live.

Smooth integration is crucial for maximizing the benefits of cloud accounting.

Resistance to Change

Employees may resist adopting new software and processes. Provide adequate training, support, and communication to help them embrace the change.

Addressing resistance to change can ensure a smoother and more successful transition.

| Key Point | Brief Description |

|---|---|

| ⏱️ Time Savings | Automation reduces manual tasks. |

| 💰 Cost Reduction | Lower IT, labor, and storage expenses. |

| 🔒 Enhanced Security | Protected financial data with encryption. |

| 📊 Real-Time Insights | Access up-to-date financial data. |

Frequently Asked Questions (FAQ)

Cloud-based accounting involves using accounting software hosted on remote servers, allowing access from anywhere with an internet connection. This eliminates the need for local installations and server maintenance.

Many businesses report savings of up to 15% annually by switching to cloud accounting. The exact amount depends on your business’s size, complexity, and existing processes, but cost reduction is common.

Yes, cloud accounting is often more secure than traditional methods. Providers implement robust security like encryption and multi-factor authentication to protect your data, as well as many ongoing updates.

Start by choosing suitable software, backing up your existing data, and planning the migration. Training employees and ensuring seamless integration with other systems are also crucial for minimal disruption.

Yes, most of today’s cloud-based accounting solutions are designed to make this process very easy. You can often seamlessly integrate with CRM, e-commerce, and project management tools for comprehensive business management.

Conclusion

Switching to cloud-based accounting can deliver substantial benefits for your small business, most notably the ability to **reduce overhead** by as much as 15% annually. By understanding your overhead costs, carefully choosing the right software, and effectively implementing and training your team, you can unlock significant savings and improve your overall profitability. Embrace the future of accounting and position your business for long-term success.