Reverse Mortgages 2025: Eligibility for Homeowners Over 62

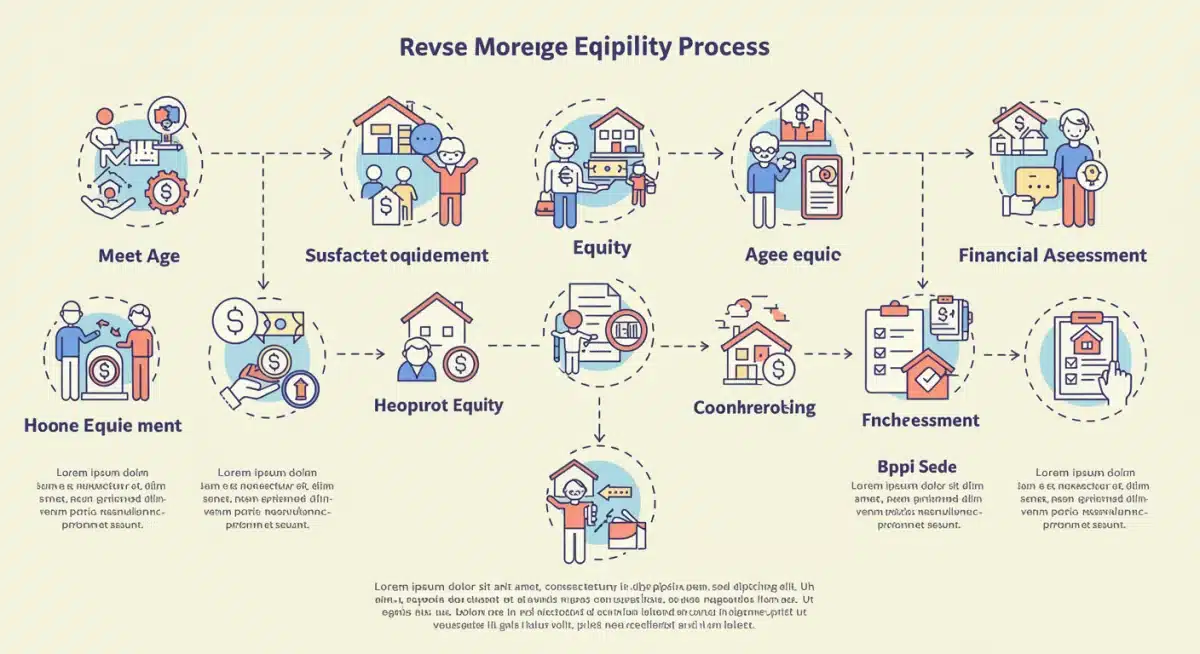

Homeowners aged 62 and older considering a reverse mortgage in 2025 face specific eligibility criteria, including age, home equity, and financial assessment, with FHA HECM loans remaining a primary option.

As 2025 unfolds, homeowners aged 62 and older are keenly evaluating their financial options, with reverse mortgage eligibility 2025 emerging as a critical topic. This financial tool allows seniors to convert a portion of their home equity into tax-free cash, without selling their home or taking on new monthly mortgage payments.

Understanding Reverse Mortgages in 2025

Reverse mortgages, specifically the Home Equity Conversion Mortgage (HECM) program backed by the Federal Housing Administration (FHA), continue to be a significant financial resource for seniors. These loans enable eligible homeowners to access their home equity, providing liquidity for various needs, from covering daily expenses to funding home improvements or healthcare costs. The core principle remains: the loan is repaid when the last borrower leaves the home permanently.

Current market conditions and regulatory frameworks for 2025 emphasize consumer protection and financial stability, ensuring that applicants are well-informed about the implications and benefits of this complex financial product. The FHA’s oversight plays a crucial role in maintaining standards and protecting both borrowers and lenders in the reverse mortgage market.

Key Eligibility Requirements for 2025

The fundamental eligibility criteria for a reverse mortgage in 2025 largely mirror previous years, focusing on age, home equity, and property type. However, vigilance is key as minor adjustments or new interpretations can occur. Meeting these core requirements is the first step in determining if a reverse mortgage is a viable option for your financial future.

Age and Homeownership Status

- Minimum Age: All borrowers listed on the loan must be at least 62 years old. This age requirement is strictly enforced and is a cornerstone of reverse mortgage eligibility.

- Primary Residence: The home must be your primary residence. This means you live in the property for the majority of the year, typically more than six months.

- Home Equity: You must own your home outright or have a significant amount of equity built up. Generally, this means owing little to no mortgage balance on the property.

These elements form the bedrock of eligibility, ensuring that the product serves its intended demographic and purpose. Without meeting these initial criteria, further consideration of a reverse mortgage becomes moot.

Property Type and Condition Standards

Beyond personal eligibility, the property itself must meet specific FHA standards to qualify for a HECM. These standards ensure the property’s value and habitability, protecting the investment for both the homeowner and the lender. An appraisal and property inspection are integral parts of this process.

Properties eligible for HECM loans include single-family homes, 2-4 unit properties (if one unit is owner-occupied), FHA-approved condominiums, and manufactured homes meeting specific criteria. The property’s condition must also meet FHA minimum property standards, ensuring it is safe, sound, and sanitary. Minor repairs may be required before loan closing.

Mandatory Counseling and Financial Assessment

A critical component of reverse mortgage eligibility 2025 is the mandatory counseling session. This session, conducted by an independent, HUD-approved counselor, is designed to educate prospective borrowers on the features, costs, and alternatives to a reverse mortgage. It’s a consumer protection measure, ensuring seniors make informed decisions.

Financial Assessment: A Deeper Look

Introduced to enhance borrower protection, the financial assessment evaluates a borrower’s capacity to meet ongoing property charges, such as property taxes, homeowner’s insurance, and homeowners association (HOA) fees. This assessment helps prevent foreclosure due to non-payment of these essential obligations.

- Income and Credit Analysis: Lenders review income sources and credit history to assess financial stability. This isn’t about denying loans based on past credit issues but ensuring the ability to meet future obligations.

- Set-Asides: If the financial assessment indicates potential difficulties, a ‘Life Expectancy Set-Aside’ (LESA) may be required. This reserves a portion of the loan proceeds to pay future property charges on the borrower’s behalf, providing an added layer of security.

The financial assessment is a crucial step that distinguishes the current reverse mortgage landscape, emphasizing long-term sustainability for the homeowner.

Impact of Interest Rates and Lending Limits in 2025

The financial aspects of reverse mortgages are significantly influenced by prevailing interest rates and FHA lending limits. These factors directly affect the amount of funds a homeowner can access from their equity. As financial markets fluctuate, so too can the attractiveness and utility of a reverse mortgage.

In 2025, interest rates will continue to play a pivotal role. Higher rates generally mean a lower principal limit (the amount available to borrow), while lower rates can increase it. Borrowers should monitor market trends and discuss fixed versus adjustable-rate options with their lender to determine the best fit for their financial strategy.

FHA Lending Limits

The FHA establishes an annual lending limit for HECM loans, which caps the maximum home value that can be used to calculate the principal limit. For 2025, this limit is subject to adjustment based on national median home prices. Staying informed about this limit is essential, as it directly impacts the maximum loan amount available.

- Maximum Claim Amount: This is the lesser of the appraised value of the home or the FHA national lending limit. It’s a critical figure in determining how much equity can be accessed.

- Loan Costs: Various fees, including origination fees, mortgage insurance premiums (MIP), and closing costs, are part of a reverse mortgage. These costs are typically financed into the loan, reducing the net proceeds available to the borrower.

Understanding these financial parameters is crucial for homeowners planning to utilize their home equity in 2025. It allows for more accurate financial forecasting and decision-making.

Common Misconceptions and Borrower Protection

Despite increased awareness, several misconceptions about reverse mortgages persist. Addressing these is vital for homeowners considering this option in 2025. Ensuring borrowers understand the true nature of the loan is a cornerstone of responsible lending and consumer protection efforts.

One common myth is that the bank owns the home. This is false; the homeowner retains title to the property. The reverse mortgage is a loan, not a sale. Another concern is leaving debt to heirs; reverse mortgages are non-recourse loans, meaning heirs will not owe more than the home’s value at the time the loan becomes due. Any remaining equity belongs to the heirs.

Protecting Your Investment and Legacy

- Non-Recourse Feature: This critical protection ensures that if the loan balance exceeds the home’s value, neither the borrower nor their heirs are responsible for the difference. The FHA mortgage insurance covers this potential shortfall for the lender.

- Required Counseling: As mentioned, mandatory counseling is a significant safeguard, providing unbiased information and helping homeowners understand their rights and obligations.

- Ongoing Obligations: Borrowers must continue to pay property taxes, homeowner’s insurance, and maintain the home. Failure to do so can lead to default and potential foreclosure, even with a reverse mortgage.

These protections and responsibilities underscore the importance of thorough understanding and careful planning when considering a reverse mortgage in 2025.

| Key Point | Brief Description |

|---|---|

| Age Requirement | All borrowers must be 62 years or older to qualify for a HECM reverse mortgage. |

| Home Equity | Significant home equity is required, typically meaning the home is owned free and clear or has a low mortgage balance. |

| Mandatory Counseling | HUD-approved counseling is required to ensure borrowers understand the product’s implications and alternatives. |

| Financial Assessment | Evaluates a borrower’s ability to pay ongoing property charges like taxes and insurance. |

Frequently Asked Questions About Reverse Mortgages in 2025

Yes, prevailing interest rates directly influence the principal limit, which is the amount of money you can borrow. Higher rates typically result in a lower principal limit, so monitoring market trends is advisable for potential borrowers.

Absolutely. You retain full ownership and title to your home. A reverse mortgage is a loan, not a sale, meaning you remain the homeowner responsible for property maintenance, taxes, and insurance.

The mandatory counseling session ensures you fully understand the reverse mortgage product, its costs, obligations, and available alternatives. It’s a consumer protection measure provided by an independent, HUD-approved counselor.

No, reverse mortgages are non-recourse loans. This means your heirs will not be personally responsible for any loan balance exceeding the home’s value when the loan becomes due. Any remaining equity goes to them.

Yes, borrowers remain responsible for paying property taxes, homeowner’s insurance, and maintaining the home. Failure to meet these ongoing obligations can result in default, even though no monthly mortgage payments are required.

Looking Ahead: The Future of Senior Home Equity

As we navigate 2025, the landscape for senior home equity solutions, particularly reverse mortgages, continues to evolve. The emphasis on borrower protection and sustainable financial planning is expected to strengthen, with potential for further refinements in financial assessment protocols and counseling requirements. Homeowners over 62 considering this option should remain engaged with reputable lenders and HUD-approved counselors to stay abreast of any emerging changes. The goal is to ensure that reverse mortgages remain a secure and beneficial tool for seniors seeking to leverage their home equity responsibly, adapting to economic shifts while prioritizing the financial well-being of older adults.